Fiat cars are an iconic Italian brand. They are known primarily for their economy-class small cars, though they do produce vans and larger cars. We’re not talking about an Italian car here, though. We’re talking green, as in greenbacks, and all the other paper – fiat – money in the world. The 23rd of March of this year in the US marked the day that killed the US dollar, though few would people know it yet. It was a day like any other in COVID country. People were enjoying their time at home, having their needs catered to them, and most of all, having an extended vacation from work so they could spend quality time with their families. And in other fairy tales, it was the day that helicopters started being used to spread financial joy to the billionaires people. Yes, a day like any other in the good ‘ol U.S. of A. Sharing the love, it’s called.

At 8:00 am EDT on the 23rd of March in Washington, DC, the Federal Reserve put out a press release, announcing, “extensive new measures to support the economy”, which had just tanked due to the coronavirus, or we should say, the mismanagement of the crisis. Or perhaps it was all planned. A lot of people seem to think so these days. It sure has helped the FIRE sector of the economy (that’s the wealthy, to us little folk).

What exactly took place on the 23rd, then? Well, it was described in a previous post, “What’s up with the Fed?” This is a follow-on article from that one. What happened was, very briefly, that the Fed started buying up junk loans and dodgy assets under the direction of BlackRock and the treasury started printing money like there was no tomorrow. As it turns out, there probably will be no tomorrow for the US dollar as the world’s main reserve currency. It may also spell the end of fiat money across the board over time. But in the process, those helicopters loaded with cash flew directly over the landed estates of the nation’s oligarchs and started spreading joy. Meanwhile, tens of millions of Americans lost their jobs and their incomes.

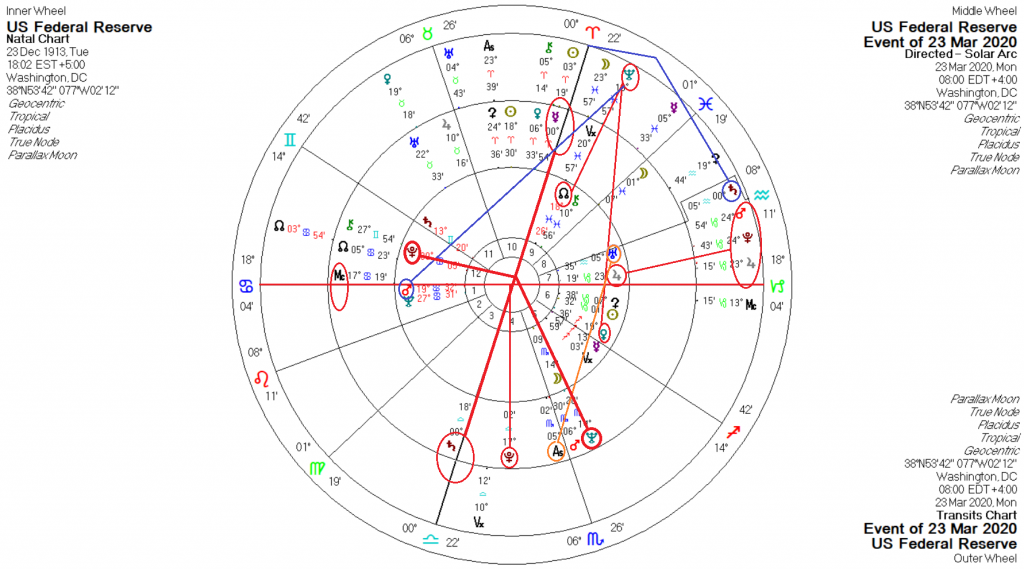

What was the Fed’s astrology like on 23rd of March 2020? The chart with transits and directions is below (bigger):

There are many factors we could parse here, but the main one is outlined in bold red, involving the Meridian axis, which has a natal square to Pluto. That natal square shows the control over the money supply to the government and to the populace. It was placed in jeopardy in that day by a direction of a natal hidden midpoint (one of a 45° modulus) to the axis: Neptune=Mercury/Saturn. That has the following meaning:

“A state of depression, distrust, emotional inhibitions. – A journey by air or by sea, the longing for far-distant places, home-sickness, an unnecessary journey, plans without any prospect of realisation.”

Further, we also have the Pluto rendering of that, Pluto=Mercury/Saturn: “The tendency to toil or grapple with unusual and special problems, the inclination to brood over one’s own destiny, plans determine a person’s destiny”

But Neptune directions to the Meridian, even hidden ones, can yield people with utopian ideas, crooks or swindlers, as well as men of big talk but not of action and weaklings. Addf Pluto into the mix and we have Nep=Plu/MC: “Peculiar objectives in life, mystic vision, a purified and refined soul-life, great imagination. – A person subject to wrong ideas, the taking of the wrong path. – The experience of grave disappointments.”

In addition to that main structure by direction, we also see that the 23rd was a Jupiter return for the Fed, to the day, which was accompanied by Mars and Pluto. Mars/Jupiter/Pluto combinations speak of phenomenal energy and effort on the one hand as well as the ability to inspire others with enthusiasm, the desire for achieving great things. On the other hand it can indicate a big swindle about to take place. That combination can speak of swindlers and oligarchs, or the squandering of wealth.

Directed Pluto was in the 4th house square the Horizon, showing the desire to attain success at all costs, a drastic or radical change in one’s life (in this case the Fed), unusual contacts (BlackRock, in this case) and acquaintances and violent disputes and quarrels. We certainly see all that in this move.

The directed Ascendant is square Uranus, showing a change in circumstances also, with a desire for greater independence. And the directed Midheaven is conjunct the Ascendant, showing, “An unusual person in unusual surroundings, a fascinating personality. – The power to exercise a strong influence upon the people in one’s environment.” This will be marked as one of the most important moments in the Fed’s history, provided it remains an institution after what is to come, discussed shortly.

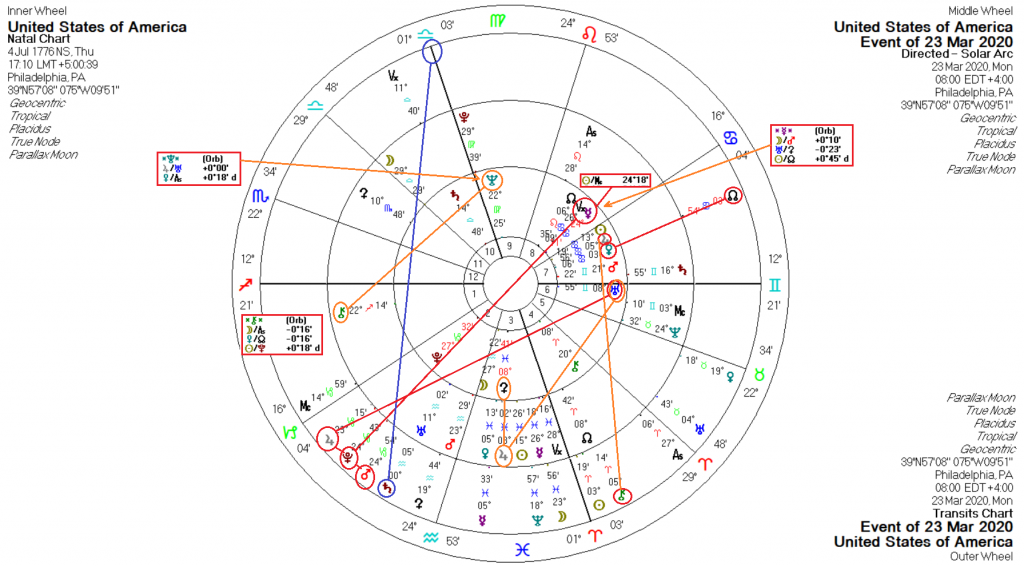

Finally, we come to the pièce de résistance – the Neptune transit in the 9th house square Venus, on the north node and trine Mars/Ascendant. Talk about controlling the narrative, this is a prime example. This gives an effective Nep=Ven/Node midpoint: Revelling or ecstatic love-notions without fulfilment, the hopelessness of a relationship, falsehood or disappointment. Trine the Mars/Ascendant, this Neptune transit gives the slick sell to the idea that this move by the Fed will solve the nation’s financial problems. For more on that, read on, but first we need to look at what was going on in the US chart on the 23rd. The chart for the US with transits and directions for the 23rd is below (bigger):

The first thing that jumps out is the transiting stellium of Mars/Jupiter/Pluto opposite natal Mercury across the 2nd/8th house axis, the financial axis of the US. It is also on the Vertex axis and within orb of natal Pluto. Mercury was receiving a direction of the Sun/MC axis, the combination reading as follows:” Self-contemplation, the process of meditating about oneself, one’s individual attitude to the world outside, to vocation and to communication or contact with others. – The gaining of experiences, seeing one’s way to achieving goals.” That was activated by the aforementioned transit.

The trio in the transit, especially Jupiter with Pluto, was about the oligarchs in the US, who were out to save their asset values, which for the moment they have done. In essence, they have weaponized (Mars) big money (Jupiter/Pluto) to prop up the markets, the message to the public being that the markets are the economy, when in effect they only represent less than a third of the US economy.

Mercury, ruling communications in general, can also be utilized to deceive, then becoming the trickster, the fraud, representing forgers and cunning as well. It sounds a lot like Neptune in its lower aspect, and in that regard there is a significant direction to Neptune from Chiron. Neptune forms a midpoint with Jupiter/Uranus.

The Nep=Jup/Ura midpoint is an important one for the United States, and has the following interpretation: “Being guided by false perceptions, being disappointed quickly, a lack of prudence and of far-sightedness. – Unearned gains, a fortunate turn after having had losses e.g. an inheritance after a death, favourable prospects after the loss of a position.”

Neptune is in Virgo, in the 9th house of foreign policy, and is squared by Mars natally from the 6th house, showing the militant nature of US foreign policy, as well as its judicial system. That is being activated now by that direction of Chiron, with its attendant midpoints, which bears consideration.

Chiron carries the midpoints shown on the chart, and with the direction of Chiron having been exact in the first part of June, those would have been affecting US foreign policy through that period, and in fact would have been in effect from a year and a half before. That was just after the US pulled out of the JCPOA, ramped up its belligerence toward China and started really putting the screws on its European allies over NATO spending and the Nord Stream pipeline. The implication with Chiron at that midpoint, squaring Neptune by direction is for a misdiagnosis of an illness, an illness of strange origin, or the illusion of an illness, Chiron representing primary wounds, illness and healing in general.

Chiron’s mythology is interesting, in that Chiron was abandoned soon after birth, then taken under wing and given special training in healing, music, prophecy and the martial arts. Due to the circumstances of his birth he was immortal, but he chose to sacrifice his immortality for that of Prometheus, who gave the gift of fire (mind) to humanity. In a battle, Chiron was struck by an arrow that had been dipped in the blood of the Hydra, giving him a mortal wound. Chiron’s nature was inherently peaceful, unlike the other Centaurs, and in honor of his sacrifice and his many gifts and teaching, he was placed in the heavens, where the constellation Centaurus bears his name, But the solar arc direction of Chiron is not important in and of itself. It is what that direction carries with it in terms of midpoints, as follows:

- Moon/Ascendant: relationships with women in general, especially legal, contractual agreements (the Descendant is also involved). 1917 turned the tide in women’s suffrage, when Chiron was directed to the US Uranus by square.

- Venus/Node: love unions, notably. This goes along with the 1st point, preceding.

- Sun/Pluto: Pioneers, fighters, persons accustomed to rule others (martyrs of their own ideas). Also, + Sudden advancement in life, the ability to establish and consolidate one’s own position as a leader, the realization of new ideas. – Physical suffering, martyrdom. – Danger to life, separation by Providence (force majeure)

There is a larger implication in these midpoints, relative to Chiron. In 1917, America was in the 1st World War, which was the catalyst that brought about the realization of women’s suffrage (an interesting term, considering martyrdom). The direction of Chiron to Uranus then completed a Sun/Uranus/Pluto combination, which is a ‘revolution combination’, and the realization of women’s suffrage produced a revolutionary change in the voting dynamics of the United States, much to the chagrin of conservatives and reactionaries.

Ninety years ago, when Chiron was on the US Neptune, a direction reflected today by the square, The US economy was spiraling downward, with few people aware that the Great Depression was about to hit, eclipsing the depression of 1920-21. It was the year that Hoover began more federal intervention in the economy, increasing tax rates on the wealthy especially, but across the board as well. It did not make him very popular. It was too little too late to stop the Great Depression, and foreign banking crises gave momentum to what was taking place in the US. Of interest, too, was that many nations were abandoning to gold standard in response to the crisis, while Hoover chose to keep the US on it. We see the opposite happening today, and that brings us to what the likely fallout from our present crisis will be. Then we will come back to the US chart.

In a recent interview with Alasdair Macleod, he outlined succinctly the probable scenario that is taking place and evolving, all the while we are told the economy in the US is doing great. He gave historical precedents, which I have seen with many other economists as well regarding the present situation in the US. And, he mentions this date of 23 Mar 2020. His main talking points are as follows, but the entire interview is worth a view:

Between the first of the year and the 23rd of March this year, the S&P lost 1/3 of its value. On the 23rd the Fed issued their statement, linked before, saying that they would throw however much money was needed to solve the nation’s financial woes. The markets switched from looking at a deflationary, gloomy future to one of inflation. The markets took off, en route to reach the highs we are seeing today, and gold and Bitcoin began their rise as well. The two – the markets and gold/Bitcoin – would seem to be contradictory, but there is a catch in that.

The 23rd was also the day that the dollar’s trade-weighted ratio topped, and it has been falling ever since. The bond market, which represents US debt, has not caught on yet because of the sheer amount of money that is being shoveled into the market. The key here to watch what will happen will be to watch the bond markets. The Fed wants to keep the bond yield low. If it fails to do so, then the situation will become completely intractable. Other nations will begin calling in the debts. The dollar will crash in value and interest rates will rise dramatically. It will be a reflection of what happened to France 300 years ago with the John Law scam, which bankrupted France.

It wasn’t just the US investor mindset that changed on that March date, but across the board in investment markets. This goes back to 1971 and the Nixon Shock, when the US was bankrupt due to its wars and Nixon took the US off the gold standard, forcing the rest of the world into a fiat currency scheme with the US dollar as the peg to which most of the others were pegged.

Cutting to the important point, what we are witnessing now with the US matches very closely what happened with the US in 1929 with the market crash. 1929 was the end of a long period of bank credit expansion. Congress had just passed the Smoot-Hawley Tariff Act. The market crashed 35% in a matter of months. By 1929 the market had reached its highest point ever at that time. When the Act was signed into law, the market crashed and lost 89% of its value by mid-1932.

What the current COVID crisis has done is to bring what would have been inevitable, given the way things were headed, forward into the here and now. Governments across the world have either forgotten their history or are ignoring it. What happened between the ‘29 crash and 1932 was that banks began to go out of business. There are some European banks, large ones, who are in serious trouble, with gearing as high as 118%, which is unheard of and which will create huge consumer debt when they crash, as in having to pay 118 euros to every euro of asset value.

The present rally lasted until around 7 July. Banks across the world are in real trouble, and no one is paying any attention to it. Except, there are some people who are in the know and they are hedging their bets with gold or Bitcoin, as they are not tied to any national currency. The simple rule is, when the markets are shaky, as they are now, gold goes up in value. It has been up at all-time highs recently. Here in Italy, we are well aware that the banks are in trouble, but people do not know exactly why. The preceding goes to explain some of it, and it rests squarely in the fiat neoliberal financial scheme under which we are currently living.

The present situation with the banks is that they must inject money into the system to keep companies afloat, but they are currently in a cycle of downturn in lending, knowing full well the bind they have put themselves in by financing junk loans and dealing in dodgy derivatives. The banks are stuck and suffering. It is a good clue to get one’s savings out of fiat currencies and into solid currency, as in gold, for instance. That is one option. Another is property. Not being a financial analyst, it is best to ask a financial consultant what the best course of action would be to take for the future. The problem is that many of those same analysts are stuck into the derivative system (i.e. neoliberal model), and thus do not see a better way out.

So, we have the banking system in trouble, worldwide. The other solution to stimulate the economy is to print money, stuff it into helicopters (figuratively speaking) and throw it out across the land, hoping that people will invest and spend it wisely. That usually does not happen. It does, however, make the FIRE sector (Financial, Insurance, Real Estate), fabulously wealthy, which we have seen, while giving the public a temporary false sense of security. The markets go up, the media points to that strong market and says “Hey! It’s all good!! Don’t worry. The President has it under control.” The problem is, that market only represents around 30% of the whole economy – the FIRE sector economy. The other 70% of the economy is where most people live, and that economy is really suffering at the moment.

Where all the preceding will probably lead is for the governments of the world to have to take control of the banks and instruct them to put money into the real economy, the 70%. This is essentially what Roosevelt did in the 1930s. There will be a systemic crisis that will precipitate the banking takeover. But then what happens when the banks go bankrupt because of overleveraging, the Fed takes over, but then foreign governments start to get shaky about the weakness of the US economy? They start to repatriate their assets and reduce their dollar holdings to a minimum, such as Russia has done and China is in process of doing. Once that happens, the Fed will have no money to pump into the economy – no money backed by assets, that is. This is why the bond market is a key indicator, because the US debt is held in treasury notes, or bonds.

So, a timeline emerges, starting with the 23rd of March: First will emerge a banking crisis, which will evolve in turn to a currency and market crisis, producing civil and government instability. In the past that has led to wars. Wiser heads in the Pentagon have cautioned against it. But the temptation would be that with civil unrest and a crisis at home, to distract the populace and galvanize them to unity by placing the crisis squarely at the feet of a foreign power, much as we are seeing put in place now against China. Having examined such a possible scenario for some time now, it probably wouldn’t happen, in my opinion. If it did, it would be short and embarrassing for the US. But this sort of thing is what people have concerns about in the lead-up to the November election.

Just to briefly touch on the subject of war, the Rand Corporation, our main war think tank, has gamed all the possibilities against various adversaries. Their models are based upon China or Russia, say, attacking one of our allies, like Taiwan for instance. The trouble with that thinking is that neither China nor Russia have any intention of attacking anyone, nor Iran for that matter. The longer they can stay out of a war, the better their economies go. The US would have to take the battle to them, and in every scenario gamed, the US loses, and badly. Home turf advantage. However, were that to happen, that would be one of the biggest illusion-busters ever for Americans, and would show the incredible waste that has been poured into ‘defense’ spending.

Keep in mind, that these war games presuppose aggression on the part of the adversary precipitating a conflict. It is the old fear of a foreign threat that is constantly put before us that is used to justify the waste of trillions of dollars over the years and has made the defense industry one of the single biggest blocs in America. And yet, these other nations just want to be left in peace. The threat they pose is that the Beltway would lose control of geostrategic assets, and then our attention would have to return to American shores. There is no direct military threat against the US or its allies.

A key to the outcome of the US election is this: If either the economy crashes around the time of the election (possible) or Trump’s tax returns are made public (also possible), or both, then we will know that Trump has outlived his usefulness to the vested interests. Another possibility is that he is left there to fulfill some other agenda, like cutting Social Security and Medicare, but the economy crashes anyway and he is made the scapegoat for decades to come. That would be a repeat of history, because Hoover presided over the Great Depression 90 years ago, in timing with the directions in the US chart. That brings us back to a couple of final points on that chart.

Lastly, with the chart of the US we see a direction of Jupiter to Ceres, a planet that represents supply and ‘bread’, but also turning points in life. That would normally represent a very positive turn of events. That idea is further enhanced by the square of the direction to natal Uranus. The direction takes place in the 3rd house, showing that the pleasant turn of events relates to public opinion (3rd house), which is very helpful in a campaign year. But then, we look at the top of the chart and see a direction of Pluto about to come into effect at the Midheaven, representing a definitive change in circumstance at the very least – a turn in destiny brought about by Providence. Given historical precedent and what we see taking place before us, it is not difficult to see how that turn in destiny will go.

Probably in the next months or maybe next year we will see financial instability increase, and then bank failures. Then, we will see the wheels start to come off the fiat – currencies, that is, and more likely a return to a universal standard, such as gold or something else. Russia and China may lead the way on that, as they have been stockpiling gold, seeing what is coming with the US. The US dollar has been like the Lamborghini of currencies in the past. It has all the appearances of becoming a 500 instead. Look up Fiat 500. You’ll get the idea.

Featured pic from Just Dial