Speculation about the many aspects of this virus has been rife on social media and sometimes heated. People are right to wonder about motives, to question the response and reaction of authorities, and especially about who is set to make gains off the crisis. The frontrunners in the latter case are the corporations and especially Bill Gates. How many people have heard of BlackRock, though? We started this series with the title ‘The Great Coronavirus Heist’. But instead of focusing on what is happening with the economy, we see diversion from a bigger issue that is staring us all in the face, and the latter revolves around a recent decision by the Trump administration regarding the financial firm BlackRock. Conspiracy? One might think so. But, given the massive amounts of funds that are now being transacted via that firm and why, we may want to be looking at that instead of a virus that will soon enough fade from the newsfeed. Viruses can come and go in a season. But BlackRock will be with us for years.

There are several things we want to examine in this post, which will serve to round out what we know about this virus thus far and the effects it will have on the US. Why are we looking at the US and not the world? Because much of the world’s finances and wealth are tied to the US dollar. What happens there affects the world economy, which will linger long after the virus is a simple page in history. For many people suspecting there are hidden agendas behind the pandemic, this will only add fuel to the fire. But as the old saying goes, where there is smoke…Here is what we will examine in this instalment (there may yet be others to come):

- The CARES Act and its astrology, the latter not examined in the second post

- BlackRock and what it really represents

- Economy: what the real US economy is in distinction to the stock and financial markets

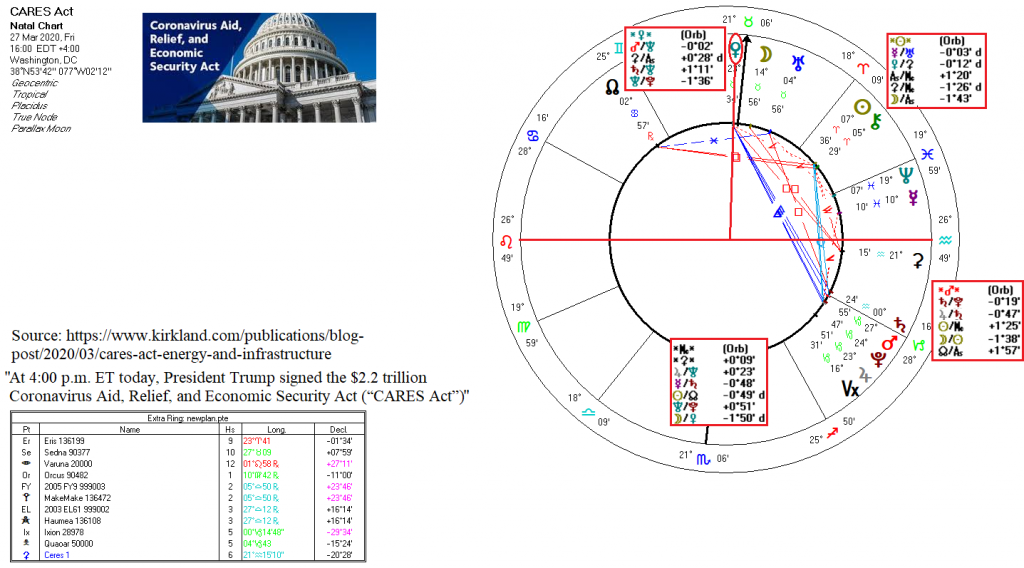

We’ll begin with the CARES Act. The CARES Act was signed into law by Trump on 27 March 2020 at 4:00 PM EDT in Washington, DC. The chart is below (bigger):

The immediate stand-out in the chart is the Aries Sun in the 8th house. The 8th house in a mundane figure, such as this one, rules debt, bankruptcy, public income, the insurance industry, corporate assets, the Treasury, taxes and bill collectors. It also rules the death of the existing state, along with other factors. The latter is not an issue here, not yet anyway. The former points are what this Act is all about. The Sabian symbol for the solar degree is interesting, regarding the preceding:

“A large woman’s hat with streamers blown by an east wind” 8° Aries

The ‘east wind’ bit is of particular interest here, as a side note, because there is a concerted effort with this and the previous US administration to distance the US from China economically, or to somehow derail China as an economic and world power. There is too much to discuss here regarding that, but in particular we have seen very heated rhetoric and smears against China and Chinese since the virus took hold in the US. That is a diversion for several reasons, as in Trump’s mishandling of the response, where the virus actually originated and from what is really taking place and is, more to the point, a case of the pot calling the kettle black.

Regarding the origin of the virus, and as a small point, there is far too much circumstantial evidence that points to the virus having its origins in the United States rather than in Wuhan. Again, we do not have the space to go into it here, but there is a rather interesting set of articles that outlines the timeline of events surrounding this virus, going back to July, if not further. (Starting here) The China bashing also sounds a lot like the manufacturing of consent (remember Iraqi WMDs?). Then there is the fact that the US was sending millions of dollars in funding to the level 4 bio-lab in Wuhan prior to the outbreak in Wuhan. But we will have to leave that for now.

According to the usual astrological delineations (houses, signs, aspects and so forth), the CARES Act looks like it should be successful, and the stock market has seen its sharpest rise in recent times upon the enactment of CARES. We find Mars, ruling the sun-sign, conjunct Jupiter and Pluto in Capricorn in the 5th house. Those in turn are trine the ruler of the 10th house (Venus), the latter conjunct the Midheaven in the 10th house. So far, so good, right?

Then, the ruler of the Ascendant (the Sun), is in the 8th house, finances as described previously. Indeed, the Act performed as intended. It boosted Wall Street and corporate stocks. But here is where the caveats kick in, and that leads to a larger question: Is boosting those sectors really the way forward, or does it simply give the illusion that the economy is really being looked after? And further, what does it say about the health of the nation, including its mental and emotional health, i.e. its sense of well-being? The 8th house is a health-related sector of the chart, after all. Is this Act going to transform (8th house) the economic health of the nation in the way it is touted?

Aspects between and sign placement of planets describe the outward energetics of a chart and how those energies tend to play out through the houses. Underlying those are the more subtle indicators in the form of the midpoints, shown in the red boxes on the chart wheel. To look at whether or not the Act will function according to the big fanfare with which it was rolled out (Leo rising), we turn to the Midheaven and its ruler, Venus. Venus sits atop a less than desirable set of midpoints for a vibrant, dynamic initiative:

- Mars/Neptune: The ‘infection axis’, showing a generalized weakness and possible misuse of energies

- Saturn/Neptune: The ‘illness axis’, showing the chronic and unhampered progress of an illness

- Neptune/Pluto: The ‘supernatural axis’, showing a lack of incentive and willpower in the maintenance of health

All the midpoints together with Venus point to some strange ideas about how things should proceed, a one-sided approach to how matters are handled and a lack of focus and/or weakness of will, this in spite of the fact that Venus is trine to Mars, Jupiter and Saturn. This is further supported by the midpoint Mars=Saturn/Pluto: “Brutality, assault or violence, ruthlessness. – The necessity to fight for one’s existence or life, maltreatment.” It is quite a powerful conjunction, one by ‘translation of light’.

We might well imagine that the financial interests in the US do indeed feel as though they are in a fight for their lives. And why?: Because that Saturn/Pluto midpoint is focused in the 5th house of speculators and financial speculation, risk-taking, income from property and the ruin of one’s credit. Unless Trump and Congress had moved to prop up Wall Street and the corporations, the financial sector would have faced a blood bath and the stock market – the playground of the wealthy – would have crashed. It may still do so.

Then, we take into account the Jupiter/Pluto conjunction in the 5th house, representing the plutocrats (Jup/Plu), with their wealth being based largely in real estate investments and financial speculations. This brings us to what is really being propped up by the CARES Act. That revolves around a fundamental problem that has been in place in the US since the Reagan years, based in the following:

At issue is how to measure “the economy.” For the wealthy One Percent, and even the Ten Percent, “the economy” is “the market,” specifically the market value of the assets that they own: their real estate, stocks and bonds. This property and financial wrapping for the “real” production-and-consumption economy has steadily risen in proportion to wages and industrial profits. It has risen largely by government money and credit creation (and tax breaks for property and finance), along with its economic rent, interest and financial charges and service fees, which are counted as part of Gross Domestic Product [GDP], as if they were actual contributions to the “real” economy.

So we are dealing with two economic spheres: the means of production, tangible capital and labor on the one hand (what is supposed to be measured by GDP), and the market for financial and property assets, along with their rentier charges that are taken from the income earned by this labor and real capital.

Financial engineering replaces industrial engineering – along with political engineering by lobbyists seeking tax breaks, rent-extraction privileges, and government subsidy. To increase property and financial asset prices and corporate behavior, companies are drawing on credit and government subsidy not to increase their production and employment, but to bid up their stock prices by share buyback programs and high dividend payouts. Buybacks are called “repaying capital,” so literally this policy is one of disinvestment, not investment. It is favored by tax laws (taxing “capital” gains at a lower rate or not at all, as compared to taxes on dividends).

Who just got bailed out by the CARES Act, then? That was covered in the second part of this series. It was the corporations and financial sector, largely, who had been using quantitative easing to buy back their stocks and bump up their share prices, thus bestowing outrageous CEO pay packets and gains by investors (stockholders), all the while keeping wages for workers frozen, based on adjustment for inflation.

The aim is still to keep the stock market afloat and buoyed. It’s an election year and Trump’s economy is reflected in the stock market. This is especially the case because we are so often told that the stock market is the measure of the health of the economy. But in fact, it isn’t the economy for the average family – the real economy of the US. The economy for workers in the US – 90% of us or thereabouts – is in what we produce and are able to spend, from the second paragraph quoted above.

Watch what happens in the stock market, then, if we want to know how the wealthy and corporations are faring. The problem is that many Americans’ retirement plans rely heavily on the stock market, as those plans are tied into them to a certain degree. So, what we have now is a catch-22 for the average worker in the US, who would see their retirement funds blow away in the wind if there is a large market crash.

Yet, with this bailout of the markets, as we saw in 2008, the average worker will not see the returns. Those will go to the CEOs when the corporations are able to buy back their stocks after a year. The corporations are not likely to use the bailouts to invest in their infrastructure. Instead, they will hoard the funds until they are able to move again. If we have the sense we are being conned, we are on the right track. But it gets better. Enter BlackRock, what the legendary trader Carl Icahn has called, “a very dangerous company.”

In the latest echo from the Lehman crisis response, on Tuesday the Fed announced that, just as it did in the aftermath of the global financial crisis, it has hired the world’s largest asset manager BlackRock to manage several of the Fed’s brand new – and quite – massive debt-buying programs as the Fed scrambles to keep the US asset bubble, which it was inflating for the past decade, from bursting and obliterating the highly financialized US economy.

Emphasis added. Most of us have the 2008 financial housing crash firmly in our memories, the stagnation that followed and the rise of the salaries of the CEOs and the skyrocketing stock prices. Just as BlackRock was called upon to sail the Obama administration’s ship through that crisis, so it is being called on again, only this time much more powerfully. BlackRock is the largest asset fund manager in the world. It is also privately owned, and their offices are in midtown Manhattan. It has been called the world’s largest shadow bank.

Coincidentally, or perhaps not, tied in with the CARES Act is this move by the Federal Reserve to begin a regime of three separate debt-buying programs, overseen by BlackRock. We take particular note that there have been no moves to regulate the markets, to address derivative bubbles, to separate out commercial and investment interests, etc. Instead, what we see is an effort to prop up was has been in place as the financial backbone house of cards of the US economy for the past 40 years. What do we realistically expect to happen in such a scenario, especially given the fact that the Fed itself is privately owned?

Adherents to neoliberal, Chicago School economics are optimistic that this move by the Fed and BlackRock will be enough to keep the US going and the world economy thus intact. This presupposes that the dollar remains as the world’s reserve currency and that trading continues to be done in dollars. That is quickly changing, though. Wall Street is happy at the moment. But then we look at the 90 year cycle we are seeing relative to US economics and a more sobering picture appears, repeating a quote from the first article in this series, regarding 1929:

This optimism concealed several threats to sustained U.S. economic growth, including a persistent farm crisis, a saturation of consumer goods like automobiles, and growing income inequality. Most dangerous of all to the economy was excessive speculation that had raised stock prices far beyond their value.

What are we facing this time around? We have the following:

- An oil glut, pushing the price of oil to or below $20/barrel. The US shale industry is dying before our eyes

- A persistent farm crisis, brought on by Trump’s trade war with China

- Growing income inequality

- Stock prices far above their true value

- Unregulated financial institutions

- A monstrous derivatives market that does not reflect anything of true value

- No national health care system, price gouging by Big Pharma and health care based in insurance premiums (private corporations, thus profit motives) instead of real care for citizens

- An economy that depends on products made – yes – in China. We cannot blame the Chinese for this. Thank the globalists, bipartisan support from Congress and corporate adventurism for that. Accountability for that lies squarely in our own policies and a lack of oversight over corporations. Bashing China now is only to shoot ourselves in the foot in this time of crisis.

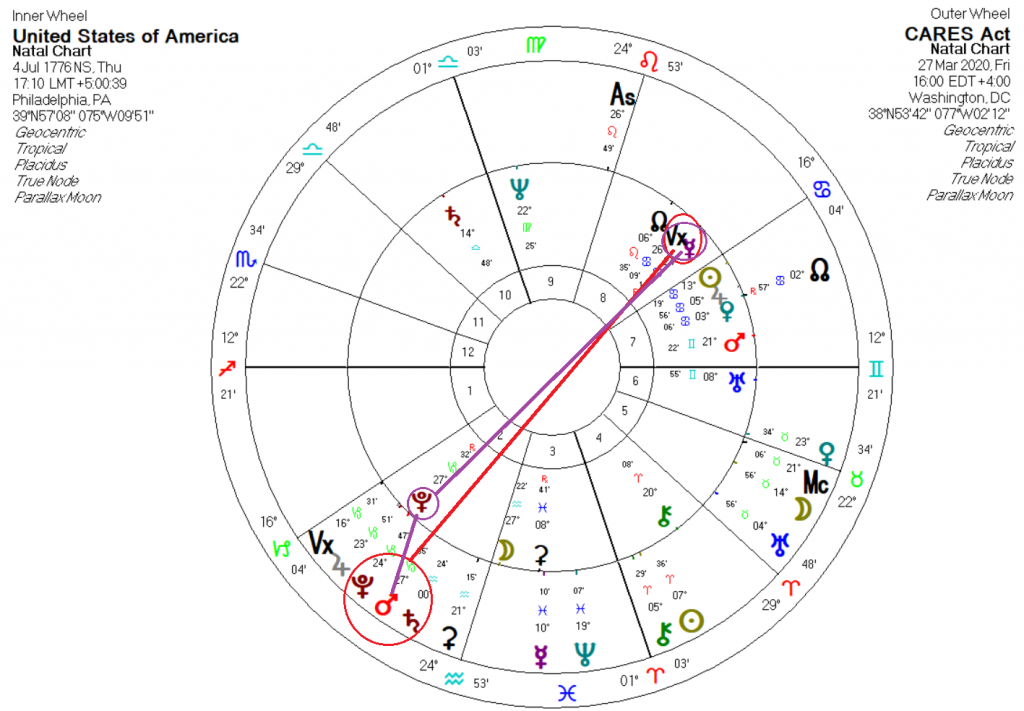

There are other points we could list, but this is enough to give us an idea. And along these lines, the US is approaching its Pluto return, which we will get to. But first, there is an interesting little asteroid that figures in the US chart, and it squares the Vertex axis in that chart at 28 Aries 14 from the 4th house, just over a degree away from the 5th house cusp. That asteroid is 128 Nemesis, and it is also square the US Pluto.

There are other points we could list, but this is enough to give us an idea. And along these lines, the US is approaching its Pluto return, which we will get to. But first, there is an interesting little asteroid that figures in the US chart, and it squares the Vertex axis in that chart at 28 Aries 14 from the 4th house, just over a degree away from the 5th house cusp. That asteroid is 128 Nemesis, and it is also square the US Pluto.

When we look at the synastry between the CARES Act and the US chart, (above, bigger) the intent and effect of the Act becomes clear. There is a natal Mercury/Pluto opposition on the US Vertex axis, and Mars, Jupiter, Saturn and Pluto in the CARES Act are all sitting on the Antivertex, conjunct Pluto and square Nemesis. The only ameliorating aspect is by Venus, which is sextile to the Vertex. This, along with handing off the purchase of ETFs by the Fed to BlackRock means one thing:

The US economy has been further privatized. The Fed is now a hedge fund.

Nemesis is the goddess who enacts retribution against those who succumb to hubris (arrogance before the gods):

NEMESIS was the goddess of indignation against, and retribution for, evil deeds and undeserved good fortune. She was a personification of the resentment aroused in men by those who committed crimes with apparent impunity, or who had inordinate good fortune. Nemesis directed human affairs in such a way as to maintain equilibrium. Her name means ‘she who distributes or deals out’. Happiness and unhappiness were measured out by her, care being taken that happiness was not too frequent or too excessive. If this happened, Nemesis could bring about losses and suffering. As one who checked extravagant favours by Tykhe (Tyche) (Fortune), Nemesis was regarded as an avenging or punishing divinity.

Why the focus on a little asteroid here? There are several reasons. Asteroids give a fine point in any chart interpretation. Chiron is a case in point, and is now used by most astrologers as a matter of course, being treated more like a planet than the little asteroid it is. But this particular asteroid, Nemesis, is quite telling in the behaviour of the US, meaning the establishment in Washington.

The Beltway these days is replete with hubris, with a propaganda machine via the media that is unmatched in the world. That propaganda machine is illustrative of the natal US Mercury/Pluto opposition across the financial axis (2nd/8th houses). This combination, in its simplest form, indicates the power of persuasion and/or suggestion. Sociologically it represents the power to influence the public or the masses, demagogues, and regarding the latter, persons who are guilty of fraudulent representation or misrepresentation in speaking or writing. We need look no further than all of the major media outlets and newspapers in the US to see this.

We hear constantly of ‘protecting American interests’, of rogue/totalitarian/terrorist and otherwise ‘misbehaving’ states in US and Western media, of the need for a strong ‘defense’, of evil-doers and threats to the US in general, and we are given a steady diet of this, along with Big Pharma ads on TV, the glamorous life we can supposedly have by engaging in conspicuous consumerism, along with endless distractions of ‘reality’ shows, game shows, sports events and religious entertainment – and very little in the way of real information about the issues that really do impact our lives. Well, it is all quickly coming home to roost. And then we add social media into the mix. But if we peel back the cover, what is behind all the rhetoric, propaganda, hype and glamour? The answer is very simple.

Everything mentioned in the previous paragraph can be traced back to economics and finance. That is what all this, meaning this entire article, is about. What we are seeing with CARES and BlackRock is about saving the bacon of the financial rentier class. ‘American interests’ means corporate and financial interests. ‘Threats’ refer to the ability of other nations to stand against and/or compete with those interests. China, Russia and Iran are prime cases in point, as are Cuba and Venezuela, to name a few. They are ‘rogue’ and do not ‘behave like normal countries’ because if they were allowed to pursue their own interests, as they should and do wish to, then American financial hegemony would quickly cease. America would no longer be ‘exceptional’, and certainly not ‘indispensable’ to the world order.

The Mercury/Pluto opposition is an aspect that is a perfect example of ‘the pot calling the kettle black’, of psychological projection and of gaslighting, when it is negatively applied. At its best, it made America the world leader in research and development for many decades. That advantage has long since been lost, and would take a generation at least to regain. It has been replaced by what we see now – anything to distract the populace from the shortcomings of the current US establishment and financial capitalism. Well, Nemesis is calling, and accounts will shortly be coming due. And with Nemesis in the 4th house natally, the public will be the ones demanding the accounting.

Coming back to the question before, what can we expect to see over the next couple of years? After the main danger of the virus has passed and the public starts to go back to work, expect the media machine to go into overdrive. We will be told we want ‘a return to normalcy’, to ‘put the past behind us’ and to ‘move forward’, to ‘rebuild America’, or even to MAGA. The stock market will rise again. Confidence will slowly return. There will be a massive campaign in the media against China. There may even be a war or military actions in the Caribbean or the Middle East. If the latter, the national debt will become stellar, notwithstanding the already 10 trillion dollars that have just been added to it. The bubble that we thought had been deflated will inflate only further.

The Pluto return for the US comes in about two years, but we are already seeing the rumblings or precursor of it now. It will follow the solar arc of Pluto to the US Midheaven coming in a year from now, marking upheavals in government and sharp changes in America’s image abroad. The best hope would be a divestment of the government from the military-industrial-Congressional-free market complex we see now. The worst case would be autocratic control by billionaires, which is where we are currently headed.

These next two years are going to see sweeping changes across the US, and probably, sadly or perhaps happily, a large financial ‘adjustment’, meaning a depression. One source has predicted an American ‘Weimar Republic’. We hold the thought that better sense prevails and the markets are sharply regulated before that can happen. However, given the preceding bullet points, a rocky road full of potholes stretches out before us. Nemesis is about to pay the US a call, and its voice will be heard through an enraged US public. That will temper the hubris of the Beltway. May it come sooner rather than later.

Featured pic from Wall Street on Parade

we will not be the next weimar. its essential people actually understand what the fed is printing.

“the Federal Reserve is not a central bank, not really. What it “prints” are, as Emil Kalinowski likes to call them, the equivalent of laundromat tokens (I wonder if they’re even that useful). Even Jay Powell knows this, but he’s absolutely thrilled that so many people believe otherwise.”

https://alhambrapartners.com/2020/05/06/everyone-knows-the-govt-wants-a-controlled-weimar/

the much larger question though is if, how and when does the current trajectory of our political system, which is openly and brazenly propping up the oligarchy, start to crumble under the weight of its own hubris? the times speak to the end of empires and this one needs to be dismantled and rendered impotent before it destroys the biosphere.