This is an article in two parts. The title of this installment outlines something that is happening before our eyes and gives the history of policies that have led to it. The second part will deal with the fallout from it, but also gives a brighter outlook for the future, which will come in a few years in all likelihood. Nations and their people – all of us – will recover over time once this has passed. But in the US and to a lesser extent in Europe, this virus is showing up something else, which is the theft of obscene amounts of money from the American taxpayers, in what amounts to socialism for corporations and the wealthiest families. That theft is what is otherwise known as bailouts. It is also to be the catalyst for coming changes in America.

Before we even start, what we see happening worldwide with the devastating effects the COVID-19 pandemic is having on our health care systems and societies in general is a heart-breaking event in our collective history. Nations that have universal health care are coping better than those who do not, but even then the results tell a sad tale in the evening news. The pandemic is raising many issues and questions. It is also showing up all the best and worst traits in people and in nations, as does any crisis. The greatest hope is that this crisis will draw out the souls of every nation, with a bonding together in the face of it. On the other hand, there are always those factions and people who would seek to profit off the chaos and the suffering that others have to endure.

To understand why we are at this juncture in the US we need to understand the past, for context. Then we will get to the astrology, so bear with the following thumbnail sketch. Our story begins with the Vietnam War and the thing that always seems to do empires in, and that is military adventurism. Eisenhower warned about such a turn of events (video, worth a watch) in his exit speech as he was leaving office in 1961, with his now-famous reference to the military-industrial complex (MIC). His warning went unheeded, and in reality was not believed except by a few.

Kennedy tried to reverse some of the growing influence of the MIC when he was in office, but instead was assassinated in 1963. With that, the die was cast for what we are now experiencing, and the MIC along with Wall Street has gone from strength to strength, being enriched with each succeeding administration on a bipartisan basis on the back of the American taxpayer, in the name of ‘defense’ and ‘protecting American interests’. The double-speak in those terms is interesting. Such support has served to gradually bankrupt America, and has made ‘supporting our military’ almost a religious mantra. After Kennedy came Vietnam under Johnson.

Vietnam caused a huge debt bubble that was unpayable under the then-present economic system, based in the Bretton-Woods gold standard. After Johnson’s tenure and in the Nixon years the debt caused by the war was causing a rise in unemployment and economic insecurity. Something had to be done. A re-election was a stake. Keep that in mind as we go along. It would have taken years of austerity and spending cuts to pay off the debt that Nixon inherited from Johnson’s years (Lyndon, not Boris) of escalation in Vietnam, years which tore both the US and Southeast Asia into pieces.

Nixon ended the war, but he also had plans for how to pay off the debt. The ‘Nixon Shock’ was the result, along with his creation of the petro-dollar. Tricky Dick’s plan payed off and he was re-elected, but his victory was to be short-lived. And the petro-dollar left the world a more unstable place.

The next event in our unfolding saga was Reaganomics, also known as the Trojan horse of ‘trickle-down economics’, giving tax cuts to corporations and the wealthy in the hope that such would buoy the economy and stimulate growth. Reaganomics did indeed buoy the stock market. As an economic model, it was an outgrowth of laissez faire economics, also known as ‘Chicago School economics’, of the type that has been the bane of many South American nations since the Nixon years. Reagan’s tenure also served to give rise to the so-called ‘religious right’ in the US and the libertarian Republican Party revival in the US that was a reaction to the Obama years. What the Johnson years saw wrought upon Southeast Asia militarily, the Nixon years and those that followed brought economically on the Americas, and by extension through Thatcher, onto Europe.

What Reaganomics did to the average American household, along with Thatcherism in the UK for the British, was astonishing, outlined as follows:

Reaganomics failed to encourage productive investment, except for selected defense contractors. Money instead poured into equities and debt instruments [derivatives], high-risk real estate, junk bond-financed leveraged buyouts, and tax-sheltered oil well and other development.

At the same time, infrastructure needs were ignored, organized labor was targeted, government became the problem, and deregulation the solution to get it off our backs. Throughout the 1980s and since: organized labor ranks declined, high-paying manufacturing jobs were lost, working American living standards declined, and an astonishing generational shift began – the annual wealth transfer of over $1 trillion from 90 million working class households to for-profit corporations and the richest 1% of the population to create an unprecedented wealth disparity.

It continues unabated and is destroying the bedrock middle class without which democracy can’t survive and is already on life support and sinking. Simultaneously, by the mid-1980s, the US went from being the world’s largest creditor to a net debtor nation for the first time since 1914.

Keep those thoughts in mind, too, as we continue. The next onslaught against the American public came with the Clinton years, specifically his relaxation of media ownership laws which has given America is current mainstream propaganda machine, a large push for globalization, the repeal of Glass-Steagall and the Banking Act of 1933 (the bedrock of FDR’s economic policy, which had protected Americans from predatory and speculative banking practices) and the blocking of oversight on a little-understood economic tool – derivatives. Those media ownership rules are a key feature of what we are seeing, because those media mega-corporations control the lion’s share of the information that Americans see and read every day and control the narrative. They are fully complicit in what is happening now.

Derivatives had been introduced, curiously or perhaps not, in the Chicago stock exchanges around the same time as the Chicago School began its dismantling of socialism in South America under the Nixon administration. Those derivatives grew in popularity in American and international trading in the years to follow. But in 1998 an obscure financial regulator, one Brooksley Born, sounded the alarm at the growth of the derivative market and the lack of the government’s oversight of Wall Street toward the end of Clinton’s last term in office. She was side-lined and silenced. The derivatives market exploded as a result.

Derivatives have a slippery history, and experience has shown that unless they are firmly regulated, they produce financial shocks and quite a bit of shady financial gaming. With the Clinton deregulation of derivatives, the stage was set for more tax cuts under “W”, along with a new mountain of debt from America’s two endless wars (Iraq and Afghanistan), onerous assaults on freedoms under the Patriot Act and a growing bubble that would result in the subprime mortgage crisis of 2008.

The Obama years were the clincher that has brought us to our present crisis. Rather than regulate the financial industry and separate out the investment and commercial banks as a result of the financial crash, as Roosevelt had done in the 1930s, Obama bailed out the banks, again with the aim of ‘stimulating the economy’. Instead, the banks and Wall Street have continued with their policies, seeking ever-more deregulation and the stock market has soared. That has been further aided by the Citizens United Supreme Court decision in 2009 which allowed for corporations to be treated as people in campaign contributions. Obama opposed it. Mitch McConnell loved it. But it embedded corruption to a large degree in the US political process.

The banks all made out like bandits as a result of the 2008 bailouts. In the meantime, Americans have suffered from job losses or having to live in a gig economy, and with little if any savings in case of emergencies, no job security and little if any social safety net. Insurance companies have become the mainstay of American health care, at exorbitant cost to working families. Hope and change under Obama was actually for the banks and insurance industry, not for the working and middle class America. Then came Trump.

Since coming into office, Trump has touted unemployment figures and the booming stock market up until the current collapse as proof of a strong economy. As a result, he signed into law a 1.5 trillion dollar tax cut for corporations, calling it ‘a bill for the middle class’. But he gave it away for what it really was, saying about the bill:

“Corporations are literally going wild over this, I think even beyond my expectations,”

Trump was elected, like Obama, on promises of hope and change, albeit by different methods. His big promise was to ‘drain the swamp’ and to end the endless wars, neither of which he has done. Instead, the first foreign visit he made was to Saudi Arabia, with the signing of some large deals for military equipment, which made Eisenhower’s MIC very happy, along with promptly increasing the defense budget and taking an axe to regulations of all sorts. The national debt has ballooned under Trump’s watch. Trump’s economic policy can be seen as ‘Reaganomics on steroids’. But he has had help, bipartisan help, from every administration and Congress, starting with Reagan. And the Democratic Party has been just as eager to enable our current form of capitalism.

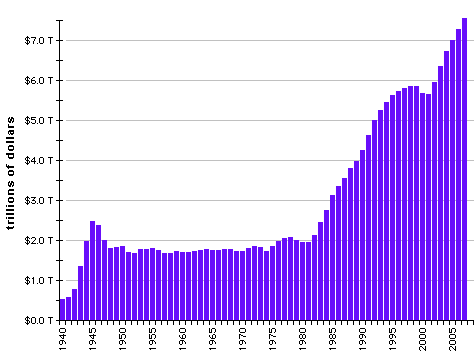

Up until the Reagan years the national debt, adjusted for inflation, was fairly stable. Under Reagan, the debt began its meteoric rise, much like we are seeing with coronavirus case in the US now. A graph shows us the reality:

Up until Reagan the adjusted debt-to-GDP level had been steady at just under 2 trillion dollars. We see that the debt began to rise in Reagan’s tenure and then took off under Clinton. And the rise of the stock market rise has followed in parallel. There is something contradictory in that picture. And the contradiction lies in the fact that the stock market does not represent the real economy, but instead the economy of the rich. Tax cuts allow corporations to buy back their stocks and push up share prices, along with the outrageous stipends of corporate CEOs.

As of the 2008 crisis, the US debt had topped over 7 trillion. That is an exponential rise. The debt now stands at over 23 trillion dollars. Where is all that money going!? Something has not been right with the American economy for a long time, and we see it with the general outline above. People know it, too. That brings us to the astrology for the US as of today, pointing to the corporate heist that is now taking place in the US.

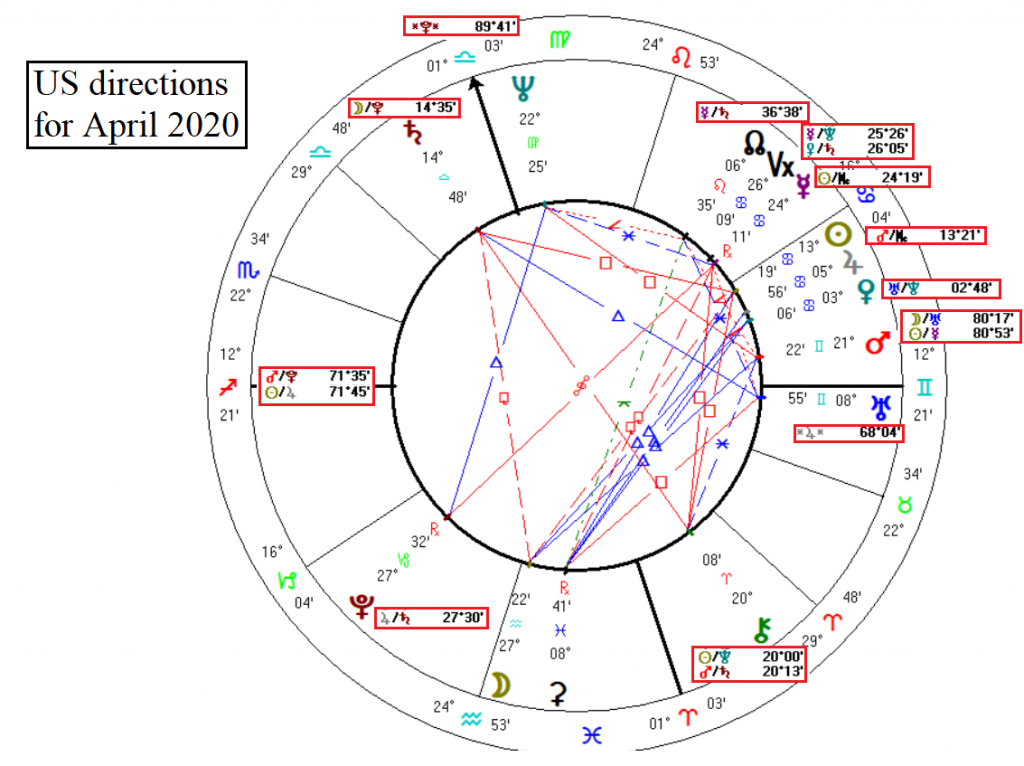

The Sibley chart for the US with directions for the end of March 2020 is below (bigger):

Several factors immediately stand out, and we will only touch on the main points here. The directed ‘infection axis’ midpoint (Mars/Neptune) is about 6 months from exactitude from the Sun/Jupiter midpoint of the natal Sun/Jupiter conjunction for the US. That means it has been in effect for at least 6 months prior. The former midpoint is a known factor in epidemics, and at the Sun/Jupiter midpoint, that dynamic is multiplied. The natal conjunction of the Sun and Jupiter shows the normally optimistic and can-do attitude of Americans, but with that midpoint there ti is weakened. That direction also shows the weakness of the initial response of the administration to the crisis represented by the virus, as well as the rapid spread of the disease and the panic once it took hold.

The direction of Jupiter to the US Uranus shows the sudden and dramatic turn of events, along with the possibility of a fortunate outcome, but the latter has to be seen in the context of other factors. That direction can also represent fortune-hunters (as in disaster capitalists) and people seeking to make a quick buck off the crisis, as well as conflicts related to one’s outlook on life, in this case, the nation’s outlook. It is one of the indicators of a deep soul-searching coming for the nation.

Then, of particular interest regarding the change in the nation’s outlook, we see the ‘revolution midpoint’ (Uranus/Pluto) about four degrees away from the nation’s Mercury by direction, which indicates that in about a year’s time or thereabouts, there will be intense mental activity, as in ‘revolutions of thought’, which will be cemented into policy in almost four years. Between now and then there will be intensive discussions and questioning by the American public as to what is happening now and why. As to what is to be questioned, that is next.

There is a direction of the Jupiter/Saturn midpoint to the nation’s Pluto: “the demonstration of immense effort. – Violent changes, separation, restriction.” Pluto is in the 2nd house of the nation’s chart, the nation’s finances, which is an interesting study in itself, as it also lies opposite the nation’s Mercury, and rules the nation’s 12th house. That placement and factors show the way in which the economy of the nation has been subverted over time and at different points in US history. The direction will be exact in two weeks.

Now, keep in mind that these same directions being described are in effect almost exactly every 90 years as far as the midpoints go. Readers familiar with such cycles will recognize that 90-year cycle as the subjective (ray) cycle of Saturn in one of its magnitudes. As the old saying goes, history tends to repeat itself. And karma (Saturn in this case) comes around to bite us in the behind, too. But for solar arcs, there is also little distinction between any of the hard aspects as to the effects they bring. 90 years ago we had the start of the Great Depression after the 1929 crash. Hoover was in office then, having been elected in 1928 on a landslide ‘red wave’, just prior to the 1929 crash. His response to the crisis then is being echoed today:

On taking office, Hoover said that “given the chance to go forward with the policies of the last eight years, we shall soon with the help of God, be in sight of the day when poverty will be banished from this nation.” Having seen the fruits of prosperity brought by technological progress, many shared Hoover’s optimism, and the already bullish stock market climbed even higher on Hoover’s accession. This optimism concealed several threats to sustained U.S. economic growth, including a persistent farm crisis, a saturation of consumer goods like automobiles, and growing income inequality. Most dangerous of all to the economy was excessive speculation that had raised stock prices far beyond their value. Some regulators and bankers had warned Coolidge and Hoover that a failure to curb speculation would lead to “one of the greatest financial catastrophes that this country has ever seen,” but both presidents were reluctant to become involved with the workings of the Federal Reserve System, which regulated banks.

In late October 1929, the Stock Market Crash of 1929 occurred, and the worldwide economy began to spiral downward into the Great Depression. The causes of the Great Depression remain a matter of debate, but Hoover viewed a lack of confidence in the financial system as the fundamental economic problem facing the nation. He sought to avoid direct federal intervention, believing that the best way to bolster the economy was through the strengthening of businesses such as banks and railroads. He also feared that allowing individuals on the “dole” would permanently weaken the country. Instead, Hoover strongly believed that local governments and private giving should address the needs of individuals.

Emphases added. Only at the end of his tenure did he begin to enact the responses upon which Roosevelt later expanded, such as the Glass-Steagall Act. Roosevelt’s expansion to that was the Banking Act of 1933, which separated the commercial and investment banks and ended the speculative bubbles to a large degree that led to the ’29 collapse. Remember what was just outlined with the Mer=Ura/Plu midpoint and ‘revolutions in thought’, because that is coming around again.

So, we see that the present event is going to lead to changes, and big ones, in the near future if the past is anything to go by. We see that a perfect storm of policies and events have yet again come into play with the current evolving economic crisis that has been triggered by the COVID-19 epidemic. But when we peel away the veil, the virus is only a cover story for the exploitation of a structural, fatal weakness that has been in play in the US neoliberal economics, and which is now ripe for the pickings for those who are left with enough money to buy things on the cheap. That system is also unsustainable and is ripe for collapse. After the pandemic has passed, we will not be returning to ‘normal’. Nor do we really wish to do so. The outlook for 2020 was to be revolutionary in the changes we will see. Keeping all the preceding in mind, we continue our story in Part II.

Featured pic from a Twitter feed