In the space of just a few days two major US banks collapsed and were shuttered, sowing panic and uncertainty in the financial markets. The first bank was the Silicon Valley Bank (SVB), the 2nd-largest bank failure in US history, and the 2nd bank failure was that of Signature Bank. Other regional banks have since also closed. Was it poor judgement on the part of the banks or is this the start of an engineered failure of the banking system in the West? These events are not isolated, but instead have broader implications. This is an evolving story. We will have a look at the reasons for the failure of SVB here and what lies ahead for the West’s banking systems in the immediate future.

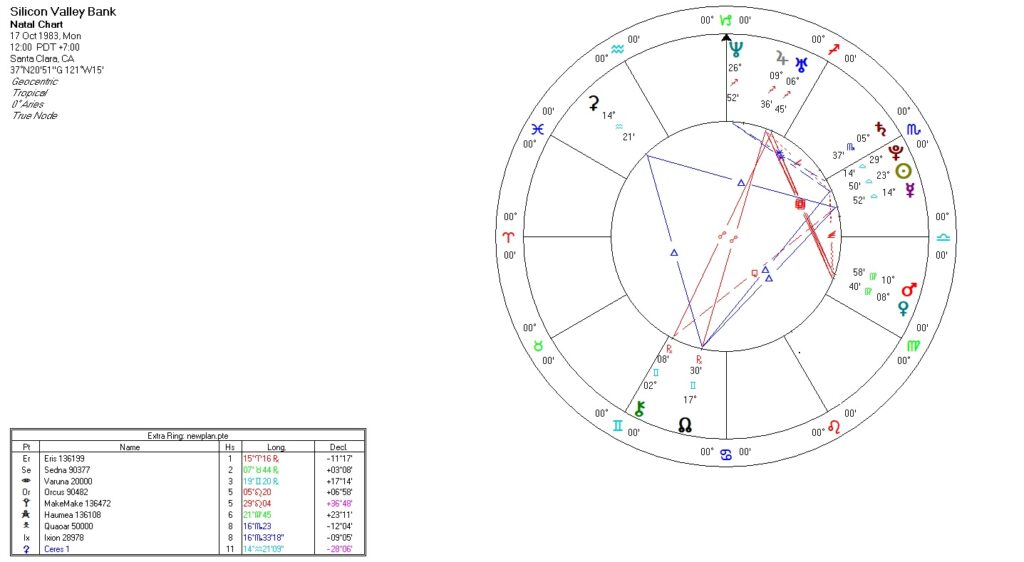

We start our investigations with the chart of SVB, primarily to see if poor policy at that bank was baked into its collapse at its conception. The chart for SVB (noon chart) is below (bigger):

The first item of note is the Jupiter/Uranus conjunction, found frequently in the charts of fortune hunters, adventurers and speculators. This automatically tells us the sort of investors attracted to such a bank – tech start-ups (Uranus), investors, speculators (venture capitalists) and the like.

Since this is a noon chart (no time of day) it is set for 0° Aries and neither the Moon nor the angles can really be considered in analysis. The only thing we can say with certainty regarding the Moon is it was in Pisces (7° at noon), showing the fluid nature of its investors and management, susceptibility to the mood of the financial sector and to external influences. If it was a morning chart or close to noon, then the situation would have been much stabilized by a trine with Saturn. More than that, though, we cannot say at this point regarding the Moon.

The Jupiter/Uranus conjunction was square a Venus/Mars conjunction, the latter giving the bank ‘sex appeal’ to investors. That can be a dangerous combination together with the previous conjunction, as people are finding. Hollywood loved SVB. There is a rumor going around now Harry and Megan, along with Oprah, are also caught up in the collapse. Jupiter was at the Venus/Mars midpoint as well, which gives the following reading: “A strong physical attraction, a rich soul-life and expression of feeling.” This combination is one of the strongest indicators of a healthy (perhaps overly-so) sex life.

All the preceding contributed to SVB having large holdings, making it the 2nd-largest bank to fail in the US when it did fail. It was the 16th-largest bank in the US. To look more closely at why, we turn to the Sun in the noon chart (the executives of the organization). The Sun is conjunct Pluto and sextile Neptune, further increasing the allure of the bank. It all looks like a dream-come-true to investors, just looking at aspects. But then we start to probe deeper and look at the midpoints, shown in the next chart, later.

The Sun is at a minute of arc from the Mars/Uranus midpoint, which points to sudden changes in fortune, injuries, accidents – it is a potentially unstable combination, and given Mars and Uranus are square in the chart, it points to a reckless attitude when not bridled by other aspects. The sextile between the Sun and Neptune is a supportive aspect for finance, pointing to ‘intuitive finance’, and up until recently the bank had been quite successful. That sextile also points to success in the entertainment/film industries.

Given the Sun/Pluto conjunction, Pluto is at the Mars/Node midpoint, giving the record achievements of the bank (16th-largest in the US is nothing to sneeze at), but it is also at the Sun/Saturn midpoint, pointing to inhibitions in development, or reticence at critical times when such holding back is counterproductive.

In total we have a picture here of a very successful bank when managed well, but with management that is overconfident sometimes and with a lack of confidence at others. It is not a stable setup. Add to this the fact that all the major planets are contained within a square (Virgo – Sagittarius) and you have a bank that is overly-focused on a singular sector – the tech/Hollywood sector. This was a West Coast bank with all that implies – Democrat dominated (in terms of investors), ‘woke’ and overly vulnerable to public opinion via its investors. Now it is box office poison, to use the Hollywood term. So, what happened? That is shown in the chart below, with transits and directions (bigger):

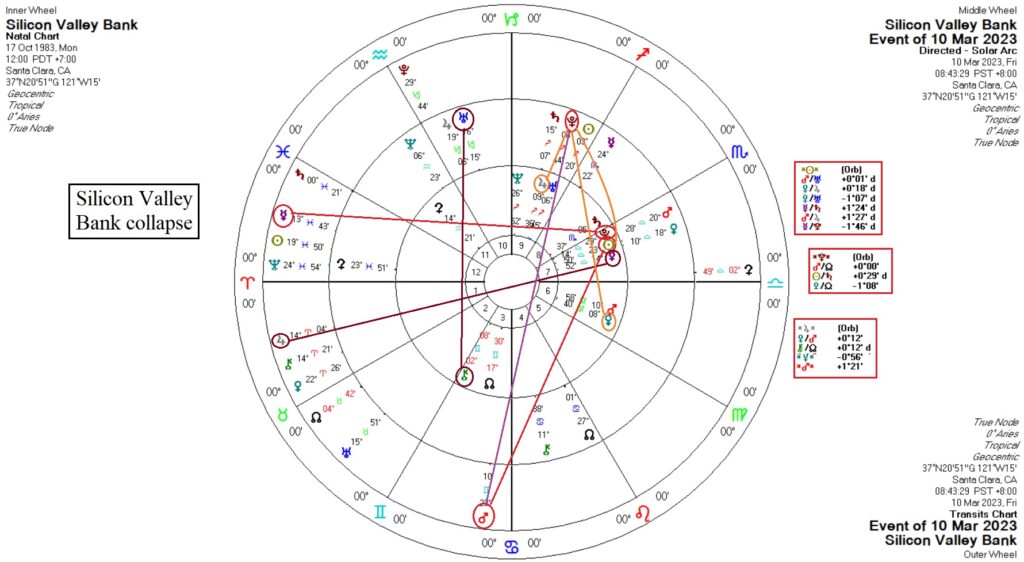

On the day of the collapse (10 Mar 2023) the entire Sun/Mercury/Pluto conjunction in Libra was lit up by transits – Jupiter opposite Mercury (failures through dishonesty, negligence or clumsiness, fraud, calumny), Mars trine the Sun (failures caused by too heavy demands) and Mercury sesquisquare to Pluto (persons who are guilty of fraudulent representation or misrepresentation in speaking or writing). The conjunction itself describes the persuasiveness of the management, their desire for recognition, and prudence and far-sightedness when well-directed (which it had in its earlier days). The transits on the day brought out all the worst qualities of that conjunction. But there was deceptiveness at play in the lead-up to the collapse. The transits brought it all to the surface.

The problems at SVB were known to savvy investors. A short seller, William C. Martin made the following observations as early as 18th January, warning his Twitter followers (read the whole thread):

“Silicon Valley Bank $SIVB reports earnings tomorrow. Investors have rightfully been fixated on $SIVB’s large exposure to the stressed venture world, with the stock down a lot. However, dig just a little deeper, and you will find a much bigger set of problems at $SIVB…

$SIVB’s big problems are with its HTM portfolio. The bank basically increased its security portfolio by 700% at a generational TOP in the bond market, buying $88 b[illion] of mostly 10+ year mortgages with an average yield of just 1.63% at Sept 30th. Oops! $SIVB’s HTM securities had mark-to-market losses as of Q3 of $15.9 b…compared to just $11.5 b of tangible common equity!! Luckily, regulators do not force $SIVB to mark HTM securities to market. But the bank would be functionally underwater if it were liquidated today…

$SIVB’s mgmt has tried to blame its challenges on its venture-related exposure. However, it is hard to hide from the fact that mgmt bought the TOP of the bond market. Tomorrow’s earnings and this year should be interesting. Caveat Emptor! (Disclosure: I am short)”

This guy saw it coming and shorted his stock in SVB, making a tidy profit for himself. Other investors (the majority) were not so savvy. I am not a financial capitalist or economist, but the gist of what Martin was saying is clear enough: The management of SVB made a bad bet, overconfident they could make it work, but didn’t do their homework and blew the lot. But they must have realized it at the last minute because a mere few days before the collapse they received themselves some very hefty bonuses for work done in 2022. Well done (sarcasm). If they were smart they are no longer in the US, in a country from which they cannot be extradited. They should be in jail for fraud. Perhaps it is too late for that, though, because the parent company and SVB’s two top executives are now being sued for fraud. Oops!

What of the directions to the chart? What do they tell us? Directed Pluto tells the tale, with Mars activating the direction: conjunction to Jupiter – the ‘plutocrat conjunction’, pursuit of fanatical aims, the desire to exploit the masses (by plutocrats), wastefulness; square to Venus – extraordinary strains in relationships; semisquare to the Sun – martyrdom, danger to life, separation by Providence (force majeure). There was also a direction of Uranus to the SVB Chiron, showing the sudden and unexpected pain inflicted on depositors and shareholders.

That ‘force majeure’ from the preceding paragraph was the Fed along with a major downturn of growth in the tech sector. The Fed had introduced steep short-term interest rate rises that made investors nervous:

“The Fed has known since before the 2014 taper tantrum that it has kept rates too low for too long. It took Covid-induced supply chain disruptions and labor market tightness and sanctions blowback to generate too much inflation. The government has been unwilling to do the heavy lifting to address at least some of these bottlenecks. We also have the not-trivial problem of companies admitting they are price-gouging because inflation in visible sectors like food makes other price rises look warranted when they aren’t. Jawboning, excess profits taxes, bans on stock buybacks could help but nothing like that has even been attempted, Instead the government has relied on the heavy hand of the Fed. Unfortunately, the Fed will have to really kill the economy to bring demand for workers down enough to make the central bank happy, particularly since the Administration is pulling in the other direction by spending on job-reshoring schemes like the Chips Act and the Inflation Reduction Act.”

The Fed rate rises were also a major factor in the crypto implosion. But there is a wider story at work here, neatly outlined by Kim Dotcom in a Twitter thread, parsed:

“US banks were provided with interest free money by the US Govt / FED for years to prop up the stock markets and to buy Govt bonds. The undocumented rule is that those banks which buy more Govt bonds get preferential treatment to access free money. The US banking system has become a tool for the US Govt to create the illusion of a strong economy by pumping the markets with Govt printed money and using banks to raise more debt. That only works for a limited time because the more money is printed the higher inflation rises.

When inflation got out of control the US Govt / FED had to stop the interest free flow of printed money to US banks and increase interest rates. Banks which got used to making big profits by manipulating the market with free Govt money started to struggle without the regular fix. The US Govt bonds that US banks bought, including with depositor funds, to qualify for more free printed money are now toxic assets with the increase in interest rates and the demand for US treasuries drying up globally. That’s what created the current crisis for US banks.

In short, US Govt driven market and debt manipulation are to blame. President Biden said today that investors / shareholders of failed US banks will not be compensated because it’s their fault for making bad investments. In reality they are victims of the US Govt Ponzi scheme…”

Couldn’t have said it better. Dotcom goes on to say the US financial system is in terrible shape. So, do we need to panic? Biden says the US banking system is safe. So, the message from the government?: Remain calm. All is well!

What is next, then, is the government will print more money to inject into the system to prop it up. We’ll see about those banking reforms, though we do reaaly need an overhaul of the banking system. It has been a bipartisan affair to deregulate. Biden will meet some stiff resistance from many members of Congress when he tries to put forward the reforms. The thing is, though, the shareholders and depositors in that bank were heavily Democrat voters. There will be heavy pressure on Biden to make sure their losses are covered.

SVB was FDIC insured, so all deposits up to $250,000 are insured. But the majority of the depositors were businesses, with deposits greater than that. If the deposits are not recovered it means business failures and layoffs because the businesses would have no funds to pay workers or debts. What will happen now with the FDIC is “the FDIC tries to find another bank to buy the failing bank and try to make all depositors whole. Insured depositors are paid first, uninsured next, and equity holders / lenders last.”

Continuing: “FDIC doesn’t usually end up putting in a lot of $ at all; whatever the gap is between deposits and liabilities tends to get made up by stockholders and lenders. And anything they do put in is made up for by charging banks higher insurance premiums. FDIC is not taxpayer funded.

The FDIC is not likely to “bail out” the deposit holders of SVB, it’s likely going to make the people who invested in SVB or loaned it money eat the losses, and if does need to put in money, it’ll pay for it by charging other banks higher premiums. One final thought: why would another bank be willing to buy a failing bank? Well, for one, they’re gonna be able to “buy” it for free—equity holders in SVB are getting wiped out. For two, banks pay a lot of money to acquire customers—and this hands them a ton of customers!”

What we have with the FDIC is not a bailout. It is the part of the system that actually works. But the big thing now for Biden and Co. is to stop the spread of panic. Representative Thomas Massey recently tweeted after a meeting with the Fed, Treasury, et al; “A Democrat Senator essentially asked whether there was a program in place to censor information on social media that could lead to a run on the banks.” The response?: “We’ll get back to you on that.”

And now Signature Bank has been shuttered, while First Republic Bank is facing serious pressures as well. Many more regional banks are also under threat. At the moment, then, this is a ‘regional’ problem, although the entire system needs a rework.

Biden has announced an extraordinary intervention to stave off a banking crisis by announcing that all SVB depositors would have access to their funds. Pressure works from Biden’s donor class. The Fed Federal Reserve is s creating a new lending facility for the nation’s banks, designed to buttress them against financial risks caused by Friday’s collapse of SVB. In other words, they will not be raising interest rates again soon.

But there is still more to this story, especially for SVB, because they were involved in funding for start-ups for the military:

“This bank is reportedly one of those little-known structures financed by the Pentagon. The bank was used for various start-ups offered to the U.S. Army, with shell structures or direct institutions that the Pentagon uses to recruit smart people from all over the world, especially since its own human resources have weakened over the past 20 years…”

No doubt, then, there will be bipartisan support to keep banks like SVB on their feet. But in terms of domestic politics, the Republicans will have a field day with this episode. The buck stops at the Oval Office, and economic downturns sink presidential election campaigns. There is far more to this story, which we will save another post in the near future, relating to foreign banks. But for now, perhaps we have a better idea of what really happened to SVB. This is the start of a major period economic instability for the US and for the bulk of the West by extension. For now, we watch this space.

Featured pic from Economic Times