This will be the first of several articles outlining the state of affairs in the West post-COVID-19. We’ll start with economics. A little over a month ago there were several headlines in open-source articles that carried the headline, “Has Trump Nationalized the Fed?”, or words to that effect. The US Federal Reserve has been a favorite of speculation, conspiracy theory, revile and even praise for years. We won’t be examining issues like foreign ownership in the Fed here. But recently, with the outbreak of the coronavirus in the US, it has been directed to start buying up junk bonds and the like to the tune of trillions of dollars at what many commentators see as an alarming turn of events, while using BlackRock as its agent. What exactly has happened to The Fed, then, and where will it likely land the country in the near future? Or the world for that matter? It’s been said that when the US sneezes the world catches cold, or in this case, a crowning virus. We’ll explore the astrology of The Fed here and see what clues are offered.

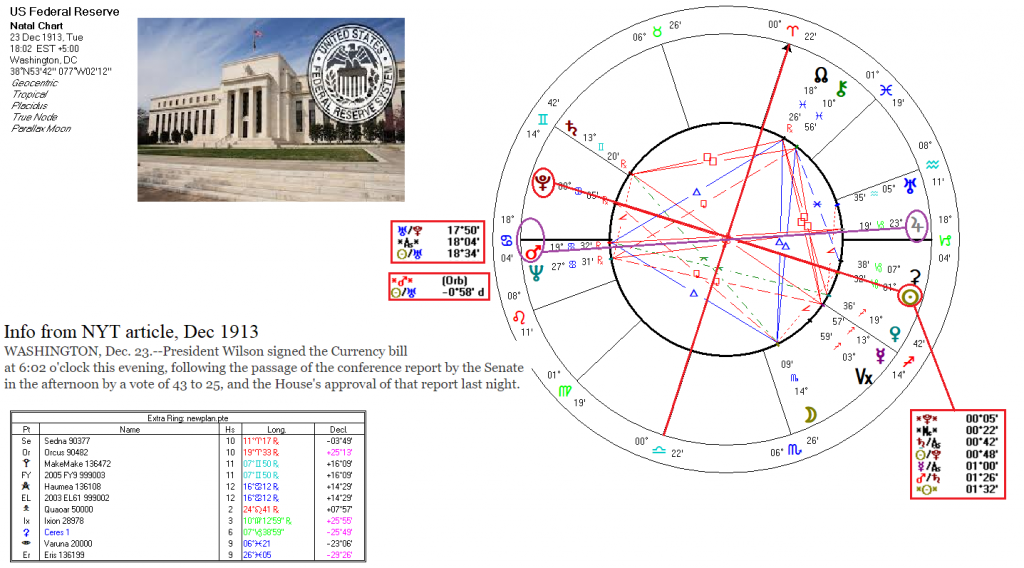

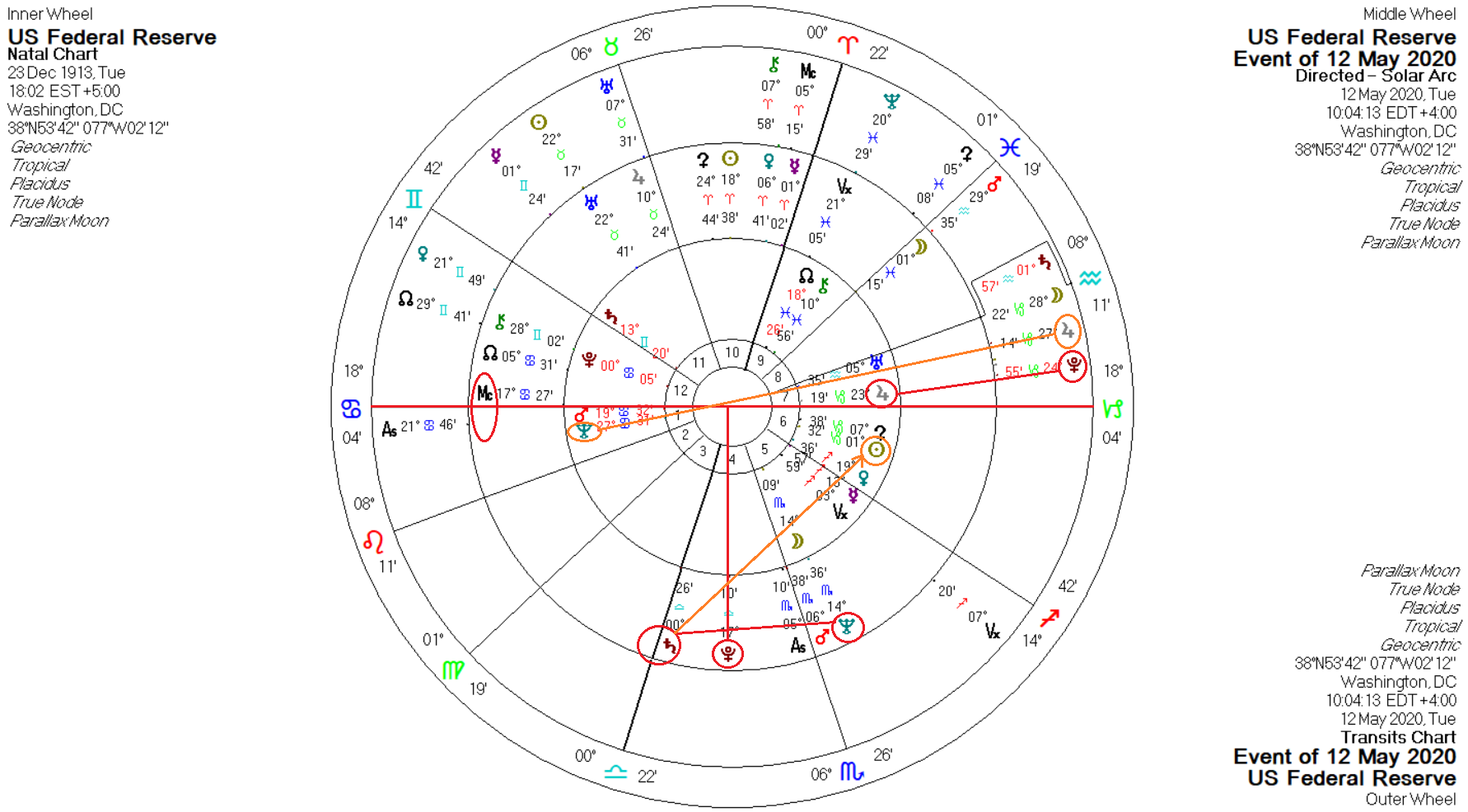

The Federal Reserve Act was signed into law at 6:02 PM in Washington on 23 Dec 1913 by President Woodrow Wilson. The chart is below (bigger);

A brief description of the chart shows us the following:

- Mars retrograde in Cancer on the Ascendant in a wide conjunction with retrograde Neptune

- A great cross with the Meridian axis, and the Sun/Pluto opposition

- Jupiter opposite the Mars/Neptune midpoint

- A partile opposition between Mercury and Saturn

- The midpoint structures to the Sun and the Ascendant

Going in order from the bullet points, Mars is in its fall in Cancer, meaning it is quite weak, further weakened in its influence by the Neptune conjunction. By the old orthodox rulerships it is in mutual reception with the Moon in Scorpio, with which it is also trine, adding a little strength. The Moon by modern rulership is also in mutual reception with Pluto, the latter retrograde as well. But the Moon is also in its fall in Scorpio. Further, the Moon is quincunx Saturn, sesquisquare Pluto and semisquare the Sun, all of which further weaken its placement.

The Cancer Ascendant and the Moon both point to the public and service of the masses. But the board of governors of the Fed, represented by the 10th house and thereby Mars, sits on the Ascendant, controlling direction of the institution and obscuring, in connection with Neptune in the Ascendant, the real intended purpose of the Fed. That purpose has always been for private banking interests, mentioned later in this piece.

Moving on, the great cross shows the controlling nature of the Fed, as well as its being controlled by hidden forces, the latter shown by Pluto in the 12th house, implying plutocrats, or ‘the 0.1%’). The Meridian axis shows that power being balanced – or perhaps better said, playing off – between the populace (4th house) and the sitting government (Board of Governors, 10th house). And of particular interest there is the fact that the Meridian axis and Pluto are all on Aries points, enhancing the power of the organization along with its capacity to shape the world view. It is no secret that the financial state of affairs in the US has large carry-on effects the world over.

It is worth mentioning here that the Aries point emphasis in the Fed chart also links it with the US MC, at the 2nd degree of Libra in the US Sibley chart. The Fed Ascendant is also conjunct the US Sun and squared by the US Saturn. The Fed has always been an instrument of government policy. But the question that has dogged the Fed all along by many commentators has been one of who actually controls either the Fed or the government, or both. Is that control foreign or domestic? Again, we don’t have the space to go into that here, and it doesn’t really matter for our current investigation.

Moving to the Jupiter=Mars/Neptune midpoint, one of the more interesting manifestations of that is that midpoint’s implication in pulmonary diseases, medically speaking, and the effect that the current pandemic is having on the American money supply. Otherwise, when stressfully influenced the reading is as follows, from Ebertin: “A fortunate turn or break after suffering disappointments or also a disappointment under otherwise fortunate circumstances, unhappiness or ill-luck in the midst of wealth.” As we will see shortly, the Fed Jupiter has recently been strongly affected and stressed, and that midpoint by extension.

The Mercury/Saturn opposition is also of particular topical interest, as it lies across the 5th/11th house axis. Mercury, the oft-times trickster, is in the 5th house (speculators and the stock market) and Saturn is in the 11th house (Congress). Congress is said to have oversight over the Fed. Mostly it is oversight after the fact. At the moment, Congress is aiding and abetting the stock market. The opposition on its own shows a generally conservative approach in financial matters, as well as the ability to research and probe deeply into matters. It can also manifest as dishonest and untrustworthy people (witnessed by the recent dumping of stocks by certain members of Congress) and a slow reaction time.

The midpoints to the Sun and angles are numerous and powerful. The Sun rules the 2nd house anyway (the banking sector), so the influences to the Sun are of particular importance to the operation of the Fed. We have already mentioned the opposition to Pluto and its effects. The closest midpoint to the Sun is the ‘death axis’ (Mars/Saturn): “Weak vitality, the inability to meet all demands or to master all situations, the necessity to overcome illness”. Then taking Pluto into account: “the rage or fury of destruction. – The intervening of Higher Power” and then finally the MC: “Endurance, the power of resistance, indefatigableness. – The necessity to overcome a lot of difficulties in life, the ability to bear the suffering of the soul (with dignity and without complaint).”

All told, the midpoint structure just described also shows how the Fed has had to function from time to time. We could consider all of the midpoints in their turn (shown on the chart), but at this juncture it is more useful to understand exactly what the Fed is and what it does. So, we have a little history here before getting to the current astrology.

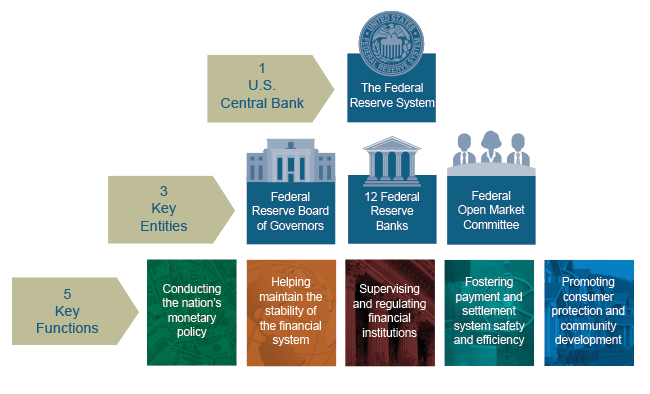

The original purpose of the Fed was to be an independent body within the US financial system to regulate the money supply and thus prevent financial collapses, as the US at that time of the Fed’s founding did not have a central bank. That’s the official story. The Fed is effectively the central bank of the US, as a unified entity. Being such, the duties of the Fed are said to be as follows:

Its duties today, according to official Federal Reserve documentation, are to conduct the nation’s monetary policy, supervise and regulate banking institutions, maintain the stability of the financial system and provide financial services to depository institutions, the U.S. government, and foreign official institutions.

Expanding on the preceding, the main functions of the Fed are thus supposed to be as follows:

- Conducting the nation’s monetary policy to promote maximum employment, stable prices, and moderate long-term interest rates in the U.S. economy.

- Promoting the stability of the financial system while seeking to minimize and contain systemic risks through active monitoring and engagement in the U.S. and abroad.

- Promoting the safety and soundness of individual financial institutions and monitoring their impact on the financial system as a whole.

- Fostering payment and settlement system safety and efficiency through services to the banking industry and the U.S. government that facilitate U.S.-dollar transactions and payments.

- Promoting consumer protection and community development through consumer-focused supervision and examination, research and analysis of emerging consumer issues and trends, community economic development activities, and the administration of consumer laws and regulations.

The italicised points will be important for later. The US financial and banking system is not easy to understand. But if we can get to the heart of the Federal Reserve system, then we are well on our way to get a handle on what is currently happening in the US with all the helicopter money being printed. To start, we need to understand that the Fed is not a single entity. It comprises a system, shown simplistically in the diagram below (bigger):

As such, the Fed is a collection of private banks, though with limitations in place. They together go to form its Board of Governors. It was originally set up as a “lender of last resort” as a backstop against bank runs.

…the Fed’s mandate was then and continues to be to keep the private banking system intact; and that means keeping intact the system’s most valuable asset, a monopoly on creating the national money supply. Except for coins, every dollar in circulation is now created privately as a debt to the Federal Reserve or the banking system it heads. The Fed’s website attempts to gloss over its role as chief defender and protector of this private banking club…

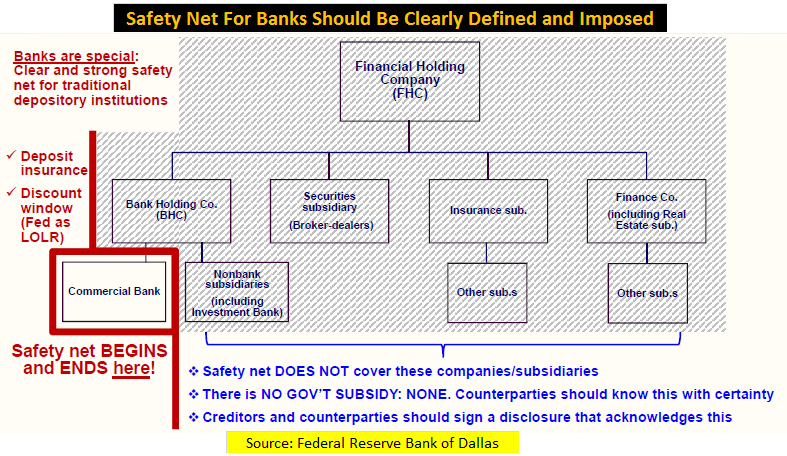

The following diagram illustrates what should be in terms of what the Fed does (bigger).

The Fed up until the present has bought secure Treasury bonds. Now, here is a key to why the current actions of the Fed could have terrible consequences for the economy in the near future: The US Treasury issues bonds when the government coffers are in short supply, as they are now. These bonds are then issued to bond dealers on the open market, which the Fed then buys. These are used to back the banks’ loans. None of the banking stocks in the twelve constituent Fed banks are owned by the government. Through a process called ‘fractional reserve lending’, the Fed will roll those bonds over many times, generating interest with each rollover, in a process that amounts to money-printing.

And now the Fed is in the process of buying high-yield (re: high risk) junk bonds. What could possibly go wrong? So, if the Fed’s total stock of bonds consists of a high percentage of junk bonds, what is actually backing the loans made by the Fed? Get the idea? If our past recent financial crises are any indication, plenty can go wrong, actually. And the coronavirus is being used as a cover story to gloss over what has been happening in recent months anyway.

The economy was teetering on the brink of a recession months before anyone heard of a coronavirus. Last September, a panicked Fed began emergency infusions of cash into the repurchasing market (REPOs), which is where banks make short-term loans to each other. The Fed’s balance sheet expansion also began in September. The Fed had been pushing interest rates down before the coronavirus panic, and it will likely keep rates at or even below zero long after the crisis related to the shutdown subsides.

Trump has been at odds with Fed Chairman Powell about interest rates since entering the White House. He wants them kept low. Every rise in interest rates deflates the stock market, which is called ‘the economy’, to varying degrees, and thus affects employment figures. Keeping interest rates artificially low, as has been happening, allows corporations to buy back their stocks, thus pushing the stock prices up. This in turn pays dividends to investors and raises the salaries of CEOs, but does nothing for real wages of workers. So, since being in office Trump has consistently favoured big business over the average taxpayer. Remember the italicised bits in the bullet points above? Here is what we are seeing as a result of the lockdowns and broken supply chains, which has only shown a light on inherent weaknesses in the system and economy anyway:

On the road more traveled, on the real side of the coronavirus economy, the pain has been historic. As of this writing, 30 million people have filed jobless claims during the COVID-19 crisis, and millions have lost their employer-based insurance.

At least one in three can’t make their rent, millions more can’t afford groceries, and workers in supermarkets, medical clinics, warehouses, and other professions are now in a macabre race to see if they’ll turn blue and die before corporate employers decide to slash their salaries or retirement benefits — which has already happened to front-line caregivers in some cities.

There are no projections of record earnings in the futures of such people. The best case is survival, and the grim reality of diminished economic horizons. Yet for the tiny sliver of people whose fortunes depend not on salaries, tips, and commissions, but upon the prices of financial products like stocks and bonds, the coronavirus response heralds a brave new world.

Since the outbreak of the coronavirus, the Fed has taken on a new direction. The Fed is now knowingly bailing out the junk bond market (video, start 9:45) to keep the stock market propped up. Those markets are handled largely through private equity firms. Private equity firms used to be called ‘corporate raiders’, doing ‘hostile takeovers’ (later called ‘leveraged buyouts’) thereafter engaging in ‘asset stripping’. This was common in the US from the ‘70s through the ‘90s.

These financial firms would borrow money to buy up companies, raid the pension funds of those companies, split them up, gut them and then sell them off, at the same time keeping the pension funds for themselves. The Fed would enable that, too, at the time by lowering interest rates on the loans used to buy out said companies. Junk bonds became increasing popular in the ‘70s after the dollar was floated as a fiat currency and regulations (consumer protections) were steadily rolled back.

Since the 2008 financial crash and the introduction of quantitative easing, we are now close to zero-percent interest rates, with the danger now being that negative interest rates in the US could become a reality. J. Powell of the Fed is resisting it, but the markets (i.e. private equity) are demanding negative interest, which really amounts to theft. Due to the massive printing of money and injection into the junk bond markets, the value of the dollar is quickly ‘softening’, or weakening. The term ‘cold, hard cash’ is thereby becoming just a page in history, so far as the American dollar is concerned.

But the large injection of cash into the markets was going on before the coronavirus, as was the steadily increasing instability in the financial system. There was a date in particular when this type of policy became enabled. That date was September 17th of last year, to be exact, and it has been prompted by economic stagnation since the 2008 crash, with the following carry-on effects:

Economic stagnation combined with zero or negative interest rates remove incentive for people to save. This depletes the supply of private capital available to invest in businesses and jobs. The lack of private capital will put pressure on the Federal Reserve to maintain, and even expand, its new lending programs indefinitely.

The preceding is the aim of the banking and investment interests, and has been for a while, in an effort to place a firewall between investors and the public. Congress at present has set up Americans to bailout Wall Street losses on the order of over 450 billion dollars:

There is nothing, whatsoever, in the 107-year history of the Fed that states or even suggests that it can lever up taxpayer money by 10 to 1 to bail out Wall Street and stick the taxpayer with the losses. This was an outrageous plan hatched out of thin air by Kudlow, Powell and U.S. Treasury Secretary Steve Mnuchin with zero regard for the legality of the plan.

When the text of the final CARES Act stimulus bill was released to the public, it allotted $454 billion to be handed over to the Fed from the U.S. Treasury. That $454 billion from the taxpayer would absorb the first $454 billion of losses of the Fed’s levered up $4.54 trillion rescue fund for Wall Street, which would include bailing out bad loans at the biggest Wall Street banks, the primary dealers (trading houses), commercial paper market, money market funds, corporate bonds, junk bonds, and Exchange Traded Funds (ETFs).

To underscore that secrecy on the part of the Fed might have to be invoked, Section 4009 of the CARES Act suspends the Freedom of Information Act for the Fed and allows it to conduct its meetings in secret until the President says the coronavirus national emergency is over.

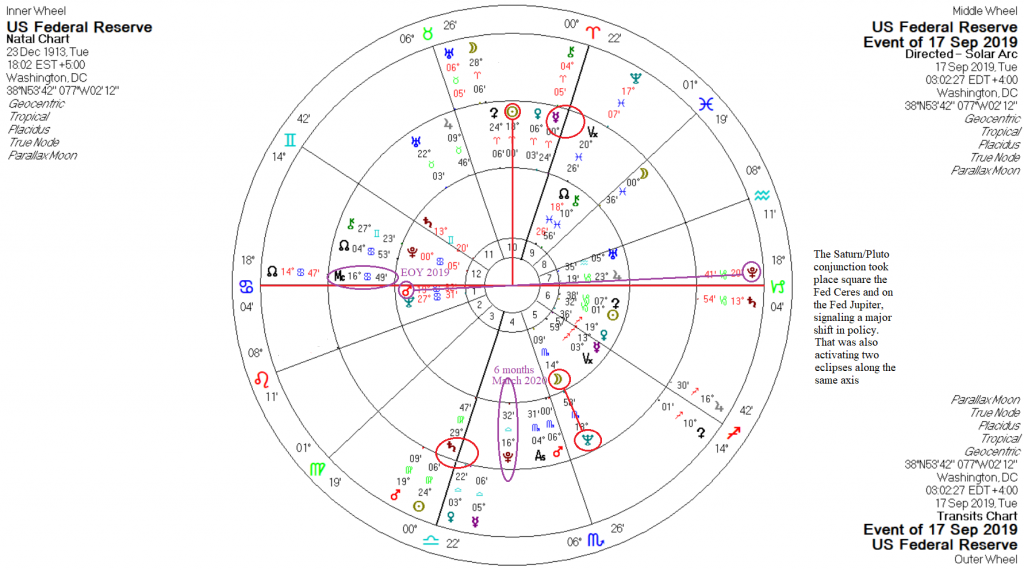

And there will be more to come. Now we come to the astrology. With all this in mind, what was going on in the astrology of the Fed at that time in September last year? The Fed chart with transits and directions is below (bigger):

The two main factors of note are the direction of Saturn to the Fed IC (lack of supply, and austerity for the public) and the start of the direction of the Fed natal great cross to the Fed Horizon. The directed Sun was to be exact in its square to the Horizon in a little less than a month from said date, with the square by directed Pluto exact in March 2020. This provoked a ‘crisis of self-preservation’ for the Fed. More aptly, it signalled such a crisis for the entire private banking sector in the US, and by extension, the money markets, a.k.a. Wall Street. Something had to be done to keep the stock prices propped up, and we see the results in the massive injections of cash into the money markets. This, we are told, is ‘the economy’.

Another factor shown in the chart is the direction of Neptune to the Fed Moon. That Moon rules the Fed Ascendant and is posited in the 5th house (investors/speculators) and shows the uncertainty that was prevailing over the markets at that time. It also shows the deceptive nature of what was taking place, in that it was the public that was actually funding all this through their tax dollars. Then in March we started hearing words from Trump to the effect of wanting to cut the payroll tax ‘for relief’, which is another version of corporate raiding of the US universal pension fund (Social Security). Members of Congress know it would be political poison to do so and have rebuffed the plan, at least for now.

The last point with the September chart is the retrograde transit of Pluto on the Fed’s Jupiter, activating the Fed’s Jup=Mars/Nep midpoint, joined there by Saturn in January and activating the two eclipses to that point at the same time. This marked the big turning point for the Fed. The Saturn transit to the midpoint, also of interest, can mark epidemics, and the Pluto transit along with it points to a brutal phase in the Fed’s history, and thereby for the American public. The current transits and directions to the Fed are shown below (bigger, and also directed midpoints):

One item not mentioned about the transit of Pluto to the Fed Jupiter is that it represents the plutocrats taking over the operations of the Fed, referring back to the Jup=Mars/Nep midpoint. The sheer scale of the deception is shown by the accompanying transit of Jupiter, now across from the Fed Neptune, but soon to retrograde back over its natal placement in July, where it will then be conjunct transiting Pluto. That is when people’s debts will be due, in the height of campaign season, with many people still afraid to go to work and with unemployment high.

The $1200 relief check people received from the CARES Act, if they received it or that much of it, will be long gone in July. And if there are still rolling shutdowns across the nation from the virus, as is likely, the summer in the US is going to be very restive. That will be about the period when possible health complications for Trump begin. It is also the period when the solar arc of Pluto to the MC of the US begins to take effect, indicating changes for the government. We won’t speculate here on what those might be. But all this brings us back to the original question in the opening paragraph: Has Trump nationalized the Fed? The short answer is no, and this goes back to its early history.

The Fed was nationalized in stages since WWI:

…the original design and purpose of the Federal Reserve was to support the economy directly. They were to buy corporate paper to PREVENT companies who could not borrow when banks were hoarding cash from laying off their employees. It was Congress that usurped the Fed for World War I and directed them to buy government paper EXCLUSIVELY. Congress effectively nationalized the Fed a long time ago transforming it into a quasi-government agency.

That now appears to have been reversed. The Fed was supposed to support the real economy, the one generated by ‘the 99%’, given the preceding. It is doing the opposite now. The meaning to what is going on is very clear. Instead of supporting the real economy, such as investing in infrastructure, ensuring people’s jobs are secure, ensuring the stability of the money supply and so forth, the Fed is now propping up the investor economy, the wealthiest of the wealthy, which will create another huge bubble in the near future, only to burst in spectacular fashion.

There is another meaning in the preceding that is clear, too: Trump has just more fully privatized the Fed, with the full support of Congress. These moves are making the stockholders rich, which include many members of Congress, while the bulk of the American public is being forced back to work, if they have work, and receiving a pittance in support. Americans are not happy (video, colourful language).

The Covid crisis has exposed contradictions in market and America First ideology. Without federal aid to state and local governments, essential personnel are being laid off even as we declare them heroes. Employer based insurance is failing, but few American politicians are willing to fully embrace single payer insurance. Meat plant workers are declared essential, but still subject to deportation, as if famed Revolutionary patriot Nathan Hale had said, “I only regret that you have but one life to give for my country.”

Ultimately, the most dangerous pestilence that threatens the country is not a packet of RNA called Covid-19 but an economic and political system that does not value true wealth, and promotes the life of the few while condemning the many to literal sickness unto death.

Trump has not ended the Fed as we know it. It has only entered the more supercharged phase of activity that was put in place at the start of the 2008 Great Recession, finally taking the mask off what the Fed has been all along – a consortium of private interests. It has been enabled by previous successive administrations, and that private influence has been growing since market capitalism became the main game in town several decades ago. Trump is ramping up what Obama started in 2008. The Fed will be coming in for reform in the next few years, but for now it is serving the oligarchs well.

A real sense of the illness in the nation’s banking system will become evident over the next year as the directions of Saturn and Neptune to the Fed’s Sun, weakening its vitality, take firmer hold in the months ahead. The true wealth of any nation is shown in the health and well-being of its people. With the virus having highlighted every weakness in the system and social fabric of the US, the ground is now fertile for the changes in financial systems that the transit of Uranus through Taurus often indicates, which has generally advanced societies. In those Uranian transits we saw the end of feudalism in Europe, two industrial revolutions and the New Deal. And for Americans struggling to make ends meet, those sorts of changes cannot come soon enough.

Featured pic from Rolling Stone

Hi Malvin many thanks for this indepth look at The Fed. Yes, something has been lurking in the swamp for a long time. It really is a lot to take in so thanking you for helping to make sense of all of this. Thanks also for connecting back to your article last year in April about Trump and the stresses he will face in 2020. I am thinking a lot these days of Bob Dylan’s song, ‘A Hard Rain’s A-Gonna Fall’. As usual I am so grateful for astrology for helping us to see the bigger picture. That is a gift. Many thanks.

Thanks Burke. We’re starting to see the first drops of that hard rain. The thunder is already there. It was an interesting investigation on my part, and it was good to be able to find a time to the minute for the chart, a rare thing in mundane charts. How this all plays out will set the tone of life in the States and much of West for years to come. The best we can do is to begin rebuilding from ‘the bottom up’, with local community efforts. Thanks for your recent donation, too. Much appreciated. Cheers!

Amazing insights Malvin, thank you! I sense the thunder is about to ‘reshape’ all aspects of the economic fields and players as we know them.