The Sun entered Aries on 20 March 2023, marking the Easter equinox for the Christian world, spring for the northern hemisphere and autumn for the southern hemisphere. The Aries equinox also marks the start of the spiritual New Year for the West. This year the Aries equinox has also marked a real turning point in world affairs. Many scores will be settled this quarter, with a new sense of direction for the world at large opening out before us. For more, read on…

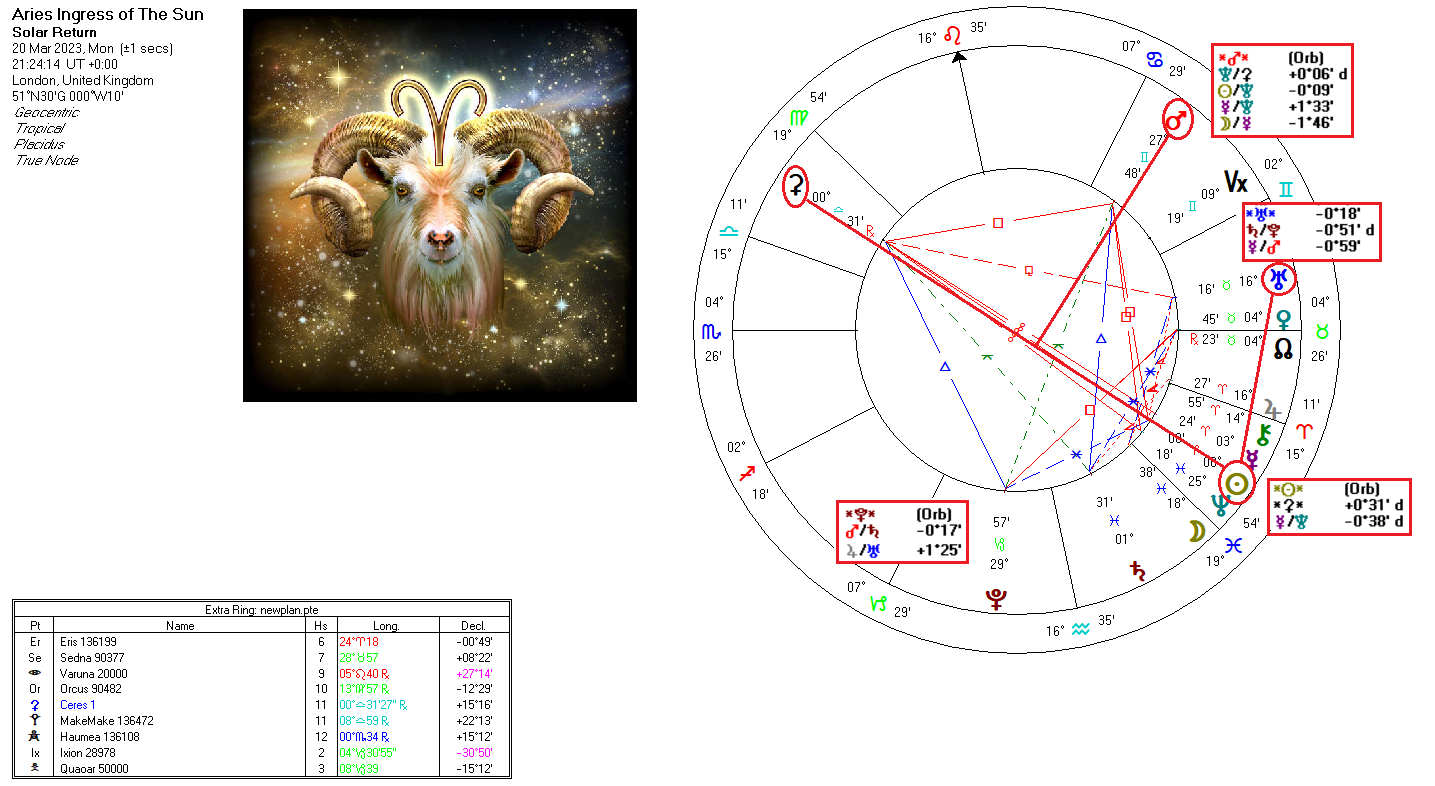

The ingress took place at 21:24 UT on the 20th of March. The chart is below (bigger):

The chart shows what is to be a very volatile and restive quarter, shown by the t-square with Mars at the apex, the base being a partile opposition between the Sun and Ceres. This also shows a turning point or crossroads in world affairs. Added to that is the semisquare of the Sun to Uranus, completing a ‘hard opposition’ to the base of the t-square, auguring many surprising and unexpected events.

The midpoints in the chart are no less indicative of the volatility of the quarter, especially with those of Uranus and Pluto. We have the following:

-

- Ura=Sat/Plu: “A person unafraid of danger, the ability to make sudden decisions in the most difficult situations. – Sudden acts of violence.”

- Ura=Mer/Mars: “To act with lightning speed, to make a decision during a state of emotional upset, the loss of self-control (frenzy, delirium or violent insanity). – An exciting surprise, a decision made in haste, action without deliberation. – The danger of catastrophes.”

- Plu=Mars/Sat: “Brutality, the rage or fury of destruction. – The intervening of Higher Power, bodily injury or harm (murder, the death of a great many people).”

- Plu=Jup/Ura: “An unusual striving for knowledge and understanding, a strong awareness of purpose or of objective in life, a far-seeing creative activity. – A sudden change in financial circumstances.”

With all this said, what do we know which is right in front of us? The US banking system is on the verge of collapse (Plu=Jup/Ura), or at the very least ‘a major readjustment’. That started with the collapse of the SVB on the 10th of March. Since then other major US banks are teetering on the edge. Europe is not immune either, as we saw with Credit Suisse in Switzerland. Credit Suisse has taken a beating in recent years and the SVB collapse nudged Credit Suisse into precarious territory. Asian investors are pulling large sums out of Swiss banks because they no longer see those banks as safe havens for their money. UBS has since agreed to buy out Credit Suisse, somewhat assuaging investors’ fears. For their part, US banks are sitting on $620 billion in unrealized losses. What could possibly go wrong?

Turning to Ukraine, the US State Department is saying the next few weeks will be critical for Ukraine. Kiev has hyped up a spring offensive (as in this quarter), especially around the heavily contested city of Bakhmut/Artyomovsk. How they propose to launch such an offensive is an open question, considering the losses they have been suffering there. More sober assessments of the possibility of any Ukrainian victory in such a scenario are very slim, and instead point toward a rout of the Ukrainians (Plu=Mars/Sat).

To Europe, France has erupted in rioting after Le Petit Roi (Macron) tried to ram through a law raising the retirement age without parliamentary debate or approval. Apparently Macron does fancy himself to be ‘the little king’. There are many in France who would prefer he met the fate of Louis XVI. So far the French government has survived two no-confidence votes, which has only further enraged the protestors. The protests may eventually force a popular referendum on the matter.

There are large rolling strikes in the UK, with strike actions planned through April. There are also strikes in Spain, Germany and other EU states over wages and benefits.

We can expect accidents resulting in large fires, too, as was recently witnessed in a massive explosion at a chemical plant in Pasadena, Texas. Lebanon has been launched into turmoil because of behind the scenes wrangling between the US and Saudi Arabia. The Saudis and the US are Lebanon’s biggest donors.

But the biggest news this quarter will be the fallout from the recent meeting in Moscow between Putin and Xi, which struck the death blow to Western hegemony. Pax Americana has been buried. It will take a few years, probably, for the Western powers to fully realize it, but from here on the influence of the Western powers will steadily decrease.

Looking at what is in front of us, from the preceding points, we can also gauge what is trending for this quarter from looking at what eventuated in the Capricorn quarter. What was forecast was a large winter offensive by the Russians, which never eventuated. The Russians do like to keep people guessing. It was largely American analysts who had forecast such an offensive, but the Russians instead saw fit to sit in place and grind down the Ukrainian military in places like Bakhmut.

The rising tensions in Europe against the US are there, but still have yet to explode. Once the truth comes out more fully about events like the Nord Stream cover-up and a rout of the Ukrainians at Bakhmut, we are likely to see tensions rise sharply in Europe.

The financial instability that was forecast has eventuated (the US banking crisis) and is set to get worse. The ongoing slow-motion collapse of the ‘Ukraine is winning’ narrative began last quarter. The ‘sudden and large change’ forecast for last quarter was there, but it was understated in the West, whereas in the Global South it was big news – the normalization between the Saudis and Iranians brokered by the Chinese. That breakthrough was a major indicator of the loss of American influence in West Asia. Then, of course, there was the tragic earthquake that rocked Tűrkiye and Syria, speaking of ‘sudden and large change’.

What we can expect for this quarter are more and sudden developments in West Asia, perhaps or probably a decisive turning point in Ukraine which will lead to a more rapid end to the war there. Speaking of wars, there is hope the rapprochement between Iran and Saudi Arabia will lead to an end of the war in Yemen.

The financial situation in the West will worsen. That probably goes without saying. The indicators are all there – insolvent banks, ongoing supply chain problems, the ongoing Brexit pains in the UK, debt ceiling debates in the US (which means an even-greater mountain of debt for the US, thus a lack of confidence in the dollar internationally), the warnings for the Italian economy flashing red, energy supply costs……need we go on?

We certainly are living in the most interesting of times, paraphrasing the old curse that is blamed on the Chinese for its origin. Blaming China for everything now is a favoured American pastime. As the real Chinese saying goes, it is “Better to be a dog in times of tranquility than a human in times of chaos.” But the world was born out of chaos, was it not? And a new one is emerging. If you are in a secure place, get some popcorn and watch it emerge. Better yet, let’s roll up our sleeves and help usher it in. Aries always rings in the new. This Aries quarter has all the hallmarks of being one of those moments in history that are the most memorable and life-changing. We can fear the change, or we can be the change.

Featured pic from Etsy India