Saudi Prince bin Salman (MbS) is at it again. In a move to consolidate his power further, several Saudi princes of lower rank have been arrested, starting on the 6th of March. As of now, up to 20 have been detained. They are accused of plotting a coup against MbS, in cahoots with several Americans and several other nationalities. Among those arrested are Mohammed bin Nayef and his half-brother, Nawaf, who were picked up at a private desert camp on Friday. There are rumors that the king is near death or is actually dead, which would explain the talk of a coup. But there is more to the story than appears on the surface.

The Saudi kingdom is in trouble. Since MbS has taken power the kingdom has been embroiled in a disastrous war in Yemen. The kingdom is haemorrhaging money due to low oil prices, the OPEC union is showing strains and is in danger of breaking up, the Iranians and Yemenis are growing in strength and have advanced weaponry that is indefensible with current Saudi technology, as shown in the recent attacks on Saudi oil facilities, and its adventurism in Syria is all but finished.

Along with the preceding, Wahabism as the state religion of the Saudi kingdom is increasingly on the nose with the rest of the world due to the terrorism it foments, and its adherents in Syria are currently being pounded out of that country by the Russians and the SAA. And as if that were not enough, the kingdom is facing serious demographic issues, a weakening of the petro-dollar as the world’s reserve currency and increasing scrutiny of its human rights record, with Kashoggi as a prime example, and then its oil extraction is facing increasing costs. Oh, and now, Russia has said “No!” to capping its oil production at the Saudis’ request. The gloves have come off. The story with Russia bears some investigation.

In the Pisces letter for this year there was a section on the waning influence of oil, as well as one on the coronavirus. The onset of the virus across the world has caused a drop in demand from oil because, well, people are staying at home. Airlines are doing it tough. People are panicking and stocking up on food, and toilet paper of all things. China has been on lockdown and Italy is following suit. Oil prices have been artificially propped up for years due to OPEC finagling of futures pricing. This is on top of a current abundance of supply. The reaction to the virus both in consumer usage of oil and in the financial markets has caused the price of Brent crude to plummet, and this has caused panic in the OPEC nations – except for Russia.

Russia is the world’s second-highest producer of oil behind the US and just ahead of the Saudis. It has a budget surplus, is increasingly diversifying its economy away from oil and has very low onshore oil production costs. It is also increasingly basing its economy on gold, which is now around its all-time high at close to $1700/oz. Russia’s operating costs for a barrel of oil in 2014 were $7.50/barrel, almost half of the costs for US oil production and almost double for Saudi oil production. Since Friday (6 March), the price of Brent crude has crashed from a price of $52/barrel at the start of the year to its current price at $33/barrel, the biggest drop since the Gulf War of 1991.

The Saudis need a price per barrel to be high in order to keep from bleeding money, and the price of oil has been too low for them for many months now. In the short term they can afford to have low prices in order to leverage other producers, but this time they cannot afford low prices. So, in their wisdom – such as it is – they have slashed the price of a barrel of oil to its present level and have offered heavy discounts to American, European and Asian consumers. Why? Supposedly to punish Russia for their intransigence in not reducing production. When Russia said ‘Nyet!’ to that production cut it sent panic through OPEC and angered MbS to no end. Apparently he doesn’t take a joke very well.

Will the price war really hurt Russia that much, though? Russia’s main customers for oil are, in order of importance, China, the Netherlands and Germany, with Poland 4th. Those four customers’ sales add up to about 2 ½ million barrels of oil per day from 2016 figures. Russia can weather the low prices for up to 6 – 10 years, far longer than the Saudis will be able to resist. The US fracking industry would collapse long before then. And then, Russia can also afford to play tit-for-tat with discounts to customers, matching or bettering Saudi discounts.

Why would Russia refuse to cut production, though? Would higher prices not benefit them? Well, of course they would. But there is another side to it. They are stabbing the Beast where it is most vulnerable, referring mainly to the US and the NATO alliance – in the derivatives market. Oil is traded in derivatives, and a lot of pension funds are tied to those derivatives. Russia can weather the price war for a long time. The Saudis and the Americans can’t. Here’s why:

- The ruble floats to absorb price shocks in dollars.

- A majority of their oil is now sold in non-dollar currencies – rubles, yuan, euros, etc. – to lessen their exposure to capital outflows

- The[ir] major oil firms have little dollar-denominated debt

- Low extraction costs.

- Its primary governmental budget ebbs and flows with oil prices.

All of this adds up to Russia holding the whip hand over the global market for oil. And they will have it for years to come as U.S. production implodes, because they [the Russians] can and do produce the marginal barrel of oil. That is why oil prices plunged as much as 10% into today’s close on the news they would not cut production.

Americans should be paying close attention to this, as should Australians and Canadians. This move by Russia will hit Australia’s fracking industry hard, too, and Canada’s tar sands, as their production costs are very high as well. Continuing:

There is a cascade lurking beneath this market. There is a lot of bank and pension fund exposure in the U.S. to what is now soon-to-be non-performing fracking debt. Liquidations will begin in earnest later this year. But the market is handicapping this now. I cannot overstate how important and far-reaching this move by Russia is. If they don’t make a deal here they can break OPEC. If they do make a deal it will come with strings that ensure pressure is lifted in other areas of stress for them.

There is yet another side to the Russian refusal, too, and it lies in cold, geopolitical calculations, particularly with the United States:

Although Russia has impressive reserves and a hefty stockpile of gold, its long-term budgetary planning is still dependent to a large degree on maintaining the stable inflow of energy-generated revenue. That might be more difficult to guarantee than ever before if OPEC+ continued to reduce output in order to raise the oil price since that actually makes US shale more competitive, which the US is weaponizing for geostrategic ends against Russia. In other words, while the country’s short-term economic interests rest in keeping oil prices high, this trend might counterproductively work against its long-term strategic ones related to balancing the budget and retaining its influence abroad. For example, the US wants to supply more of the European marketplace if it can successfully delay the construction of Nord Stream II, and it also has plans to double its exports to India in order to ultimately sell five times as much of this resource to the world’s fastest growing energy market than Russia will. In addition, the US provocatively wants to poach the entire Belarusian energy market from Russia, too.

Russia has had enough of the West’s foolishness, sanctions and encroachment on its borders, along with Washington’s efforts to scuttle Nordstream II, and it has found the perfect opportunity to hit back at them. They also know that the Saudis will not be able to hold out, which will mean deals will have to be struck with strings attached in order for their production to be cut. The purge of the Saudi princes came the day after the refusal by the Russians to cut production. The two events are linked. MbS is certainly foolish, but he is not entirely stupid. He sees what is coming, and this price war will eventually place a heavy strain on the kingdom. His leadership will increasingly come under scrutiny as this oily game of chicken unfolds.

Unfortunately, the price war will hit the nations who form the Axis of Resistance the hardest – Iraq, Iran, Syria and Lebanon, and this is part of the reason why there is a price war now – to try to break that axis. The move by the Saudis will have tacit support by members of the Washington establishment. We say ‘unfortunately’ for those nations because they are not the main aim of the game here. This is primarily between the Russians and the West, via the OPEC proxy. It is a covert war, and the Axis of Resistance nations are collateral players. We can most likely expect the Russians as well as the Chinese to offer support to the Axis of Resistance in other ways. It is in their security interests to do so, especially with Iran.

But here is the big takeaway from what is evolving between the Russians and the Saudis in the price war:

It is an opportunity for the Russians to finally break the stranglehold the petro-dollar has held on the world since the Nixon years.

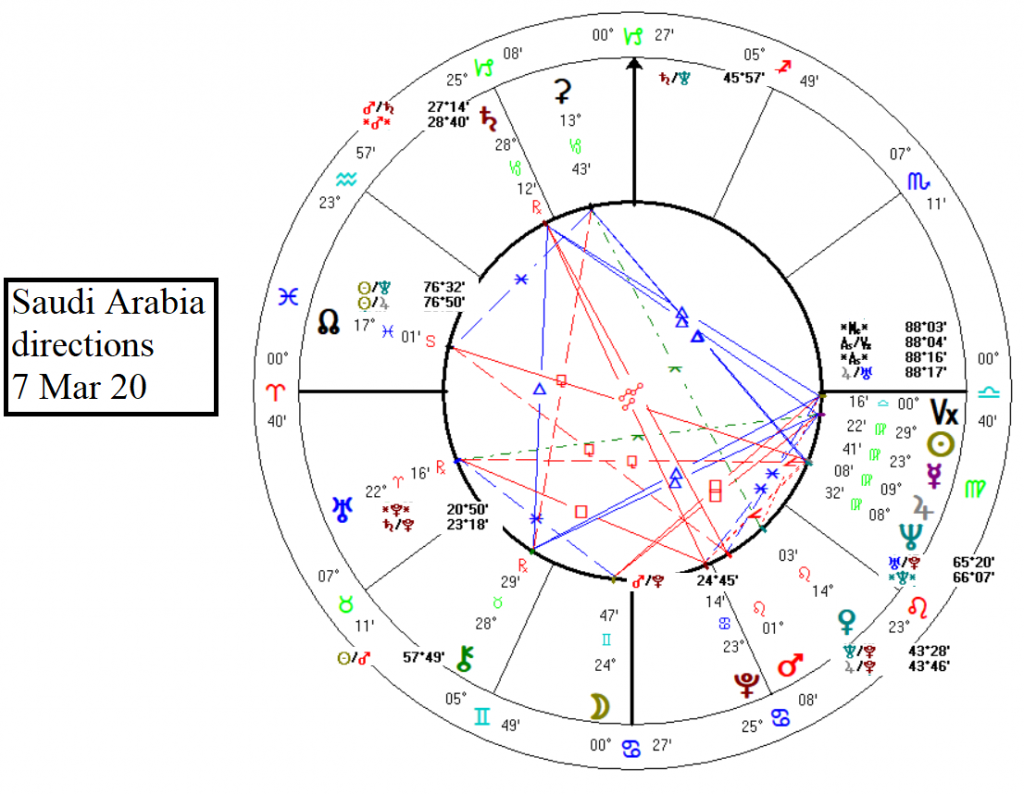

The Saudis are in big trouble by what they are doing, and they are playing straight into the Russian bear strategy. The Saudi chart with directions is below (bigger):

In discussing the Saudi chart before we take note of the Jupiter/Neptune conjunction in the 6th house, one reading of which can be ‘big oil used as a weapon’. The conjunction speaks of their vast reserves of oil anyway, but the 6th house is also associated with services, including the military. The Saudis have done this sort of price war before, but they have never lasted for very long. The Saudis will be running a deficit with their present strategy, as oil is their chief export, their economy almost entirely dependent on it. There is currently a direction of the Uranus/Pluto midpoint a few degrees away (read: ≈ 3 years) from that Neptune.

The Uranus/Pluto midpoint is our ‘revolution midpoint’, showing that the events taking place now in the Saudi Kingdom will produce a new order there in a few years of time, revolving around their oil production. It will also conjoin Jupiter around 7 months after the exact conjunction with Neptune. Normally that would indicate a huge success, but times are different these days. MbS should be focusing on diversifying the Saudi economy and public services (6th house again) instead of this petulant action against Russia. As usual, though, there is another side.

Neptune in the Saudi chart is the ruler of Pisces, intercepted in the 12th house of the Saudi sunset chart. It is not beyond thinking that someone has put the Saudis up to this price war, as in 12th house influences – covert, hidden and so forth. There is no need to say who that ‘someone’ might be. But it can also represent a simple case of acting against their own interests, as in self-sabotage.

The Jupiter/Neptune conjunction is an aspect that can indicate grand speculations and apparent happiness. ‘Apparent’ is the operative word there, Neptune giving the appearance of happiness if not the fact. And in the extreme, the conjunction can lead to poor speculations, losses through political intrigues, seductions and scandals. The Saudis have certainly demonstrated those in the past, too. The conjunction is not otherwise well aspected, being stressfully aspected to both Pluto and Uranus by semisquare and sesquisquare, respectively.

In the positive, the approaching Ura/Plu midpoint can give an deep interest in occult matters (doubtful with the Saudis), as well as a great sympathy for other people and universal love – again, doubtful for the Saudis, given their human rights record and their funding of terrorism and Wahabism worldwide.

Instead, what we are likely witnessing with their current fit of pique is the result of insecurity and uncertainty, their unfulfilled wishes as to the production cuts, a general fatigue over failed projects in the Middle East, and neuroses produced by their losses in economy and recent attacks against them by the Yemenis, the latter who are gaining ground. This is against the backdrop of a genuine desire to reform their society in a more modern and progressive direction – again, at least in appearances – which is also another indicator of the aforementioned directed midpoint to Neptune.

The insecurity in the Saudi kingdom has been highlighted by the recent direction by 45° modulus of the Saturn/Neptune midpoint to the Saudi MC, which in one respect indicates wavering between materialistic and idealistic concerns, as well as a definite darkening of the mood within the kingdom. That was exact 6 months ago, which coincided with the attacks on the Abqaiq oil facility, and also with the murder of Jamal Khashoggi in the lead-up to that a year before. Those events have provoked quite a bit of insecurity within the kingdom and tarnished its public image.

A weakening of Saudi relations will be seen in the coming months, speaking of its international relations, as the Sun/Neptune midpoint comes within exactitude of it conjunction with the nodal axis. That can also indicate the death of the king or his loss of power to his son. Their price war is not going to win them any friends, markedly so with the major energy producers, as in Royal Dutch Shell and Exxon-Mobil. Those two companies have seen their stock values plummet as a result of the price war, which is due to their production costs being high.

The Saudis are facing considerable problems at home, too. They have a high birth rate, high unemployment, a culture among Saudi men that shuns work (they have a high number of migrant workers to fill the gap) and a population of which half is under 35 years old. They also have a high poverty rate (≈25%) and few women in the work force (about 20%), with the male work force at only 62%. They are unable to provide jobs for their young people, which breeds discontent. Those are not good numbers. And they want to start a price war? It may not go so well for MbS.

Unlike in November 2017, when he launched his first purge against the business elite when the crown prince was at the height of his popularity, and known both inside the kingdom and without as a reformer, MBS is hated more than ever in his family. More than 18 months later, the crown prince’s reforms are quagmired, the price of crude oil has dropped after Russia refused last week to cut production, and discontent is mounting in the kingdom over the crown prince’s decision to seal the holy sites in Mecca and Medina from all pilgrims for Umrah – just months before the Hajj is due to start – over the coronavirus outbreak.

The Russo-Saudi price war is another one of those catalytic events, like the coronavirus, which is probably going to dramatically shift the geopolitical spectrum in the immediate future. It is an evolving situation that bears careful watching. The Saudi chart shows the Mars/Saturn (death) axis within orb of their Saturn by direction. MbS had better play his cards well if he hopes to rule for long. Saturn rules their 10th house – the sitting leader.

The next 12 months are going to be very ‘interesting’ in Saudi Arabia, to say the least. And the Orange One in the White House is now seeing red as he watches the havoc unfold in the stock market and his No. 1 economy – Best Ever! – sinking beneath the Saudi quicksands. Economies win and lose elections. The next months in the US are going to be very ‘interesting’ as well.

Featured pic from égalité et Réconcilation

Excellent thank you!